Converting LIFO-based accounts to a FIFO basis General Motors (GM) is the largest vehicle producer in North

Question:

Converting LIFO-based accounts to a FIFO basis General Motors (GM) is the largest vehicle producer in North America. It is also a leading provider of financial services. Set out below are key numbers from its 2001 accounts relating to its industrial activities (‘Automotive, communications services, and other operations’). Amounts are in US$ million.

2001 2000 Net sales 151,491 160,627 Gross profit 15,871 22,324 End-2001 End-2000 Current assets 37,063 41,147

(of which: Inventories 10,034 10,945)

Total assets 323,969 303,100 Current liabilities 56,346 55,740 Total liabilities 126,171 116,704

You wish to compare GM’s financial performance with that of other major car producers. You discover that although car companies value inventories in different ways, most provide FIFO information in the notes to the accounts. You decide therefore to convert key GM numbers to a FIFO basis.

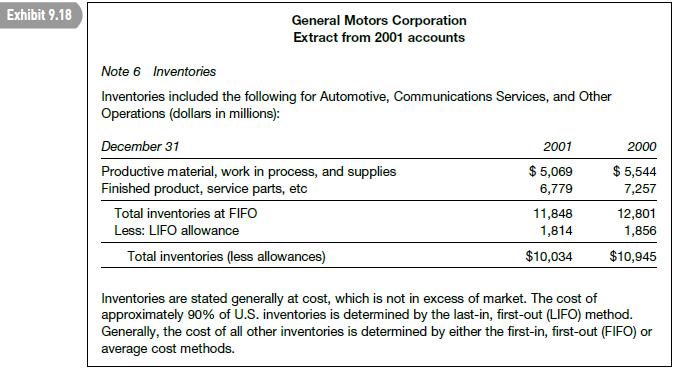

Exhibit 9.18 contains the note on inventories taken from GM’s 2001 accounts.

Required

(a) Calculate GM’s inventory turnover rate (cost of sales/average inventories), current ratio and gross profit margin ratio in 2001, using the unadjusted numbers in GM’s accounts.

(b) Adjust GM’s inventory and gross profit figures to a FIFO basis, using the information in Exhibit 9.18. Recalculate the ratios in (a). Contrast the unadjusted and adjusted ratios. Why is inventory turnover lower but the gross profit margin ratio barely changed under the FIFO basis?AppenedixLO1

Step by Step Answer: