Debt, lease commitments, and financial statement analysis The French group, LVMH, produces and distributes a range of

Question:

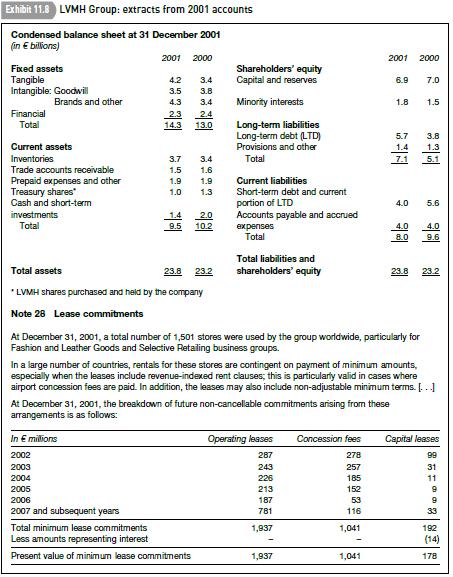

Debt, lease commitments, and financial statement analysis The French group, LVMH, produces and distributes a range of branded luxury goods such as Louis Vuitton leather and luggage goods, Christian Dior perfumes, Moët & Chandon champagne and Hennessy cognac. It also owns a chain of airport duty-free shops through which it sells some of its own merchandise (as well as that of other companies). Its 2001 sales and pre-tax income were A12.2 and A0.7 billion respectively. Exhibit 11.8 contains a condensed end-2001 balance sheet for the group as well as details of its lease commitments taken from note 28 of its 2001 accounts.

Required

(a) In the financial review accompanying the 2001 accounts, management state that net debt increased from A7.4 billion at end-2000 to A8.3 billion a year later.

(i) Using information from the condensed balance sheet in Exhibit 11.8, show how these numbers are derived.

(ii) What is the group’s debt–equity ratio at the end of 2001?

(b) What is the lease liability LVMH reports on its 2001 balance sheet? (The liability is included in

‘Long-term debt’.) In the note on tangible fixed assets, LVMH discloses that assets acquired or financed under capital leases amount to A249 million (at net book value) at end-2001. Why does this number differ from the lease liability LVMH reports on that date?

(c) Many analysts argue that minimum payments under non-cancellable operating leases and similar contracts are no different in substance than required payments under debt agreements.

(i) If this reasoning were applied to LVMH’s accounts, estimate by how much the group’s end-

2001 net debt would increase. (Hint: Assume that the group will make annual operating lease payments of A195 million for four years after 2006 and annual concession fees of A58 million in 2007 and 2008, all the payments are made at year-end and the rate used to discount them is 6%.)

(ii) Would capitalisation of operating lease and concession fee payments have a significant impact on the group’s end-2001 debt–equity ratio?AppenedixLO1

Step by Step Answer: