Question:

Divestment of a business: interpreting financial disclosures*

British Telecom (BT), the UK telecoms group, assembled all its wireless operations in a new subsidiary, mmO2 plc. Because BT’s fixed line and wireless operations had ‘different market focus and expected growth characteristics’, its board of directors decided in 2001 to split off mmO2. Under the scheme, two new holding companies, BT Group and mmO2, were established, one for fixed line and the other for wireless operations. A BT shareholder received one share in BT Group plc and one share in mmO2 plc for every share they held in the old BT. Trading in the shares of the two companies began on the London Stock Exchange on 19 November 2001.

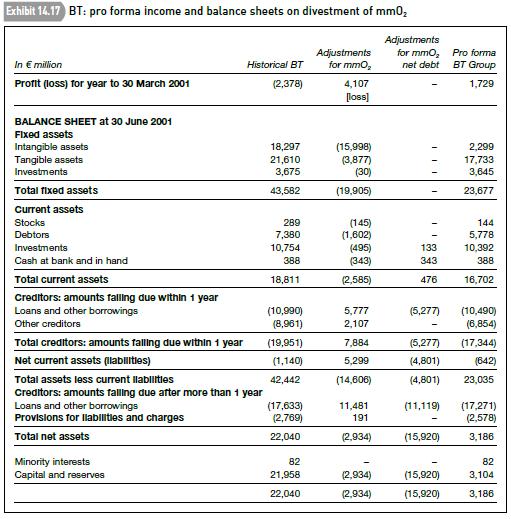

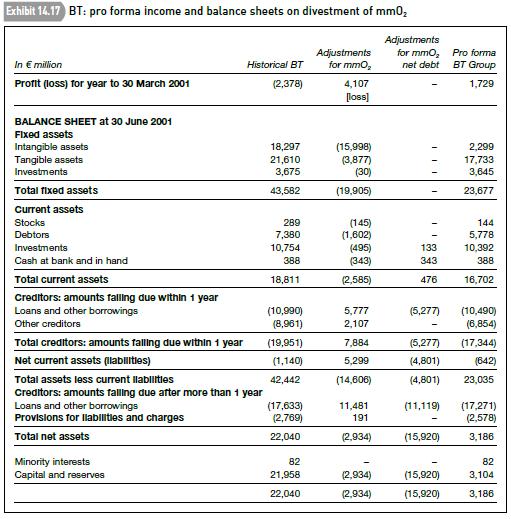

Exhibit 14.17 shows the pro forma balance sheet of BT Group plc – after adjustment for mmO2 plc

– at 30 June 2001.

BT’s management decided that, in view of mmO2’s current losses and its expected heavy capital outlays, it should carry less debt as an independent entity than it had as part of BT. As a result, debt was transferred from mmO2 to BT Group (see third column of Exhibit 14.17).

Required

(a) What type of divestment is BT’s splitting-off of its wireless operations – a trade sale, IPO, spin-off or equity carve-out? Give reasons for your answer.

(b) Show in summary form the entries BT made in its consolidated accounts to record the divestment of mmO2 and adjustment of mmO2’s net debt on 30 June 2001. Combine operating assets and operating liabilities in one line entry and debt and liquid assets in another. Why doesn’t BT report a gain or loss from its divestment of mmO2?

(c) What was mmO2’s net debt at 30 June 2001 after adjustments?AppenedixLO1

Transcribed Image Text:

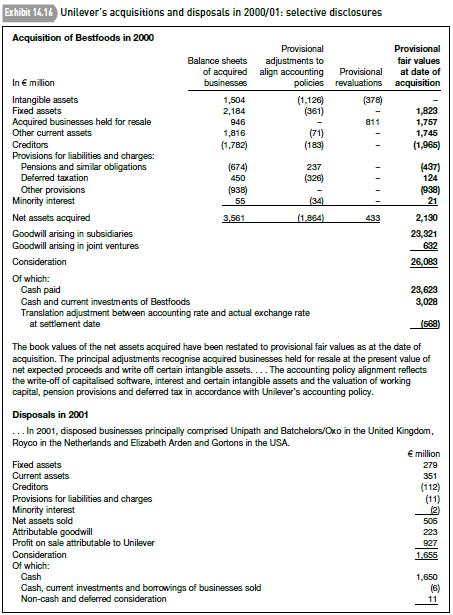

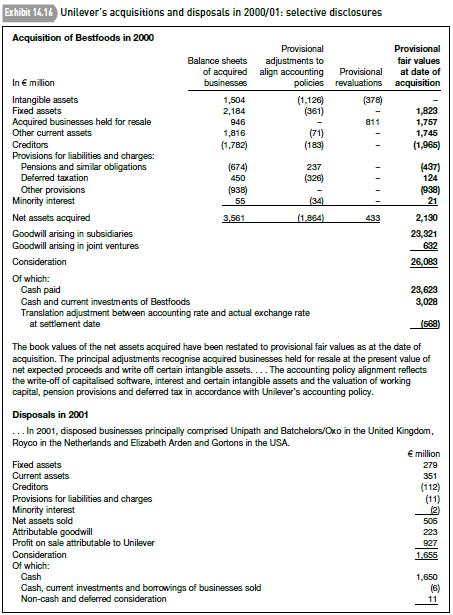

Exhibit 14.16 Unilever's acquisitions and disposals in 2000/01: selective disclosures Acquisition of Bestfoods in 2000 Balance sheets In million of acquired businesses Provisional adjustments to align accounting Provisional fair values Provisional at date of policies revaluations acquisition Intangible assets 1,504 (1,126) (378) Fixed assets 2,184 (361) 1,823 Acquired businesses held for resale 946 811 1,757 Other current assets 1,816 (71) 1,745 Creditors (1,782) (183) (1,965) Provisions for liabilities and charges: Pensions and similar obligations (674) 237 Deferred taxation 450 (326) Other provisions Minority interest Net assets acquired (938) 55 (34) (437) 124 (938) 21 3,561 (1.864) 433 2,130 Goodwill arising in subsidiaries 23,321 Goodwill arising in joint ventures 632 Consideration 26,083 Of which: Cash paid 23,623 Cash and current investments of Bestfoods Translation adjustment between accounting rate and actual exchange rate at settlement date 3,028 (568) The book values of the net assets acquired have been restated to provisional fair values as at the date of acquisition. The principal adjustments recognise acquired businesses held for resale at the present value of net expected proceeds and write off certain intangible assets.... The accounting policy alignment reflects the write-off of capitalised software, interest and certain intangible assets and the valuation of working capital, pension provisions and deferred tax in accordance with Unilever's accounting policy. Disposals in 2001 ... In 2001, disposed businesses principally comprised Unipath and Batchelors/Oxo in the United Kingdom, Royco in the Netherlands and Elizabeth Arden and Gortons in the USA. Fixed assets Current assets Creditors Provisions for liabilities and charges Minority interest Net assets sold million 279 351 (112) (11) 2 505 223 927 Consideration 1,655 Of which: Cash 1,650 Cash, current investments and borrowings of businesses sold Non-cash and deferred consideration (6) 11 Attributable goodwill Profit on sale attributable to Unilever