Dividends and other appropriations of profit: impact on the accounts Repsol YPF is a large Spanish integrated

Question:

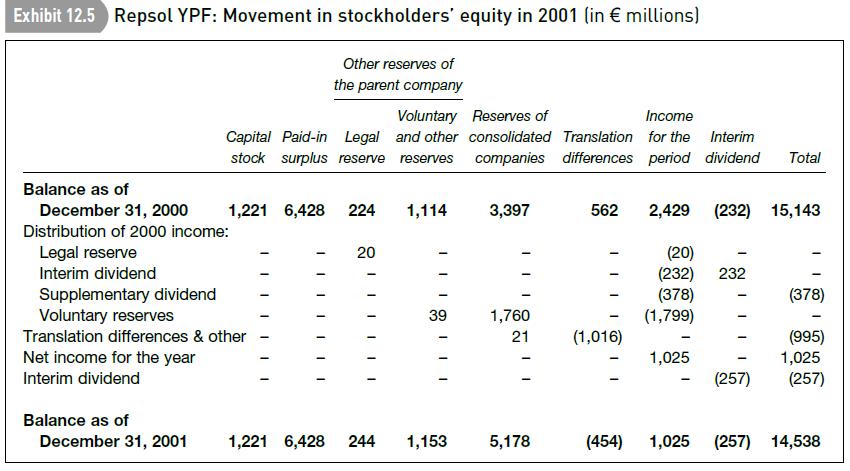

Dividends and other appropriations of profit: impact on the accounts Repsol YPF is a large Spanish integrated oil and gas company that has extensive oil and gas holdings in Argentina. Exhibit 12.5 contains an extract from the note on ‘Stockholders’ equity’ in the Englishlanguage version of its 2001 accounts.

Under Spanish corporation law, a company must transfer 10% of its net income each year to a legal reserve until the balance in the reserve reaches at least 20% of capital stock (i.e. share capital).

‘Paid-in surplus’ is another term for the share premium account. The column ‘Translation differences’

shows the exchange gains or losses that arise from translating the net assets of Repsol YPF’s foreign businesses, including its investments in Argentina, into euros.

Repsol YPF paid interim dividends of A232 million (A0.19 per share) in 2000 and A257 million

(A0.21 per share) in 2001. Shareholders at the company’s annual general meeting in 2001 approved a supplementary dividend of A378 million (A0.31 per share) for 2000 but the following year accepted management’s recommendation that none be paid for 2001.

Required

(a) Why didn’t Repsol YPF transfer 10% of 2000 net income to legal reserve in 2001?

(b) Why does the company show an ‘interim dividend’ as a deduction in the shareholders’ equity section of the balance sheet each year?

(c) What was the dividend paid by Repsol YPF to its shareholders in 2001?

(d) What is the company’s dividend pay-out ratio in 2000? in 2001?

(e) With the information Repsol YPF discloses in its 2001 accounts, it is possible to determine the distribution of its 2001 income in 2002.

(i) What is the amount the company must transfer to legal reserve in 2002?

(ii) What is the expected transfer to voluntary reserves in 2002?

(f ) Why do you think management recommended no supplementary dividend be paid out of the company’s 2001 income?AppenedixLO1

Step by Step Answer: