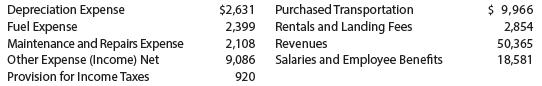

FedEx Corporation (FDX) had the following revenue and expense account balances (in millions) for a recent year

Question:

FedEx Corporation (FDX) had the following revenue and expense account balances (in millions) for a recent year ending May 31:

a. Prepare an income statement.

b. Compare your income statement with the income statement that is available at FedEx’s website (http://investors.fedex.com). Under Annual Report, select Download PDF. What similarities

and differences do you see?

Transcribed Image Text:

$ 9,966 Purchased Transportation Rentals and Landing Fees Depreciation Expense Fuel Expense Maintenance and Repairs Expense Other Expense (Income) Net $2,631 2,399 2,854 2,108 9,086 50,365 18,581 Revenues Salaries and Employee Benefits Provision for Income Taxes 920

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (12 reviews)

a Revenue 50365 Expenses Depreciation expense 2631 Fuel expense 2399 Maintenance and ...View the full answer

Answered By

Antony Mutonga

I am a professional educator and writer with exceptional skills in assisting bloggers and other specializations that necessitate a fantastic writer. One of the most significant parts of being the best is that I have provided excellent service to a large number of clients. With my exceptional abilities, I have amassed a large number of references, allowing me to continue working as a respected and admired writer. As a skilled content writer, I am also a reputable IT writer with the necessary talents to turn papers into exceptional results.

4.50+

2+ Reviews

10+ Question Solved

Related Book For

Corporate Financial Accounting

ISBN: 9781337398169

15th Edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

Question Posted:

Students also viewed these Business questions

-

Fed Ex Corporation had the following revenue and expense account balances (in millions) for a recent year ending May 31: a. Prepare an income statement. b. Compare your income statement with the...

-

FedEx Corporation had the following revenue and expense account balances (in millions) for a recent year ending May 31: a. Prepare an income statement. b. Compare your income statement with the...

-

FedEx Corporation had the following revenue and expense account balances (in millions) for a recent year ending May 31, 2011: a. Prepare an income statement. b. Compare your income statement with the...

-

What is the expected spot rate at the end of the year assuming PPP? initial spot rate 87.60 Expected US inflation 2.20% Expected Japanese yen inflation 0.00%

-

Suppose meiotic drive affects both pollen and ovules but that 80% of the pollen grains carry the A allele while 80% of ovules carry the a allele. What fraction of offspring from a selfing...

-

Calvin reviewed his cancelled checks and receipts this year for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005....

-

4. Charity care provided by a not-for-profit hospital: a Is reported as an operating expense in the statement of operations of unrestricted funds b Is reported as a deduction from gross patient...

-

Monica Sexton filed a petition for Chapter 13 reorganization. One of her creditors was Friedmans Jewelers. Her petition misclassified Friedmans claim as $ 800 of unsecured debt. Within days,...

-

Bono Company recently incurred the following costs: 1. Purchase price of land and dilapidated building $350,000 14,000 39,000 24,000 2. Real estate broker's commission 3. Demolition costs of...

-

A single plate clutch with both sides of the plate effective is required to transmit 25 kW at 1600 r.p.m. The outer diameter of the plate is limited to 300 mm and the intensity of pressure between...

-

Triton Consulting is a consulting firm owned and operated by Jayson Neese. The following end of- period spreadsheet was prepared for the year ended April 30, 20Y3: Based on the preceding spreadsheet,...

-

On December 28, 20Y3, Silverman Enterprises sold $18,500 of merchandise to Beasley Co. with terms 2/10, n/30. The cost of the goods sold was $11,200. On December 31, 20Y3, Silverman prepared its...

-

The defendant, Sterile Technologies, Inc., purchased a sterilizer from the plaintiff, Troy Boiler Works, on an installment payment plan. The defendant was to make installment payments charged with

-

How do cognitive biases such as confirmation bias, anchoring, and the availability heuristic influence the quality of decision-making within complex organizational contexts ?

-

What role do cognitive biases, such as confirmation bias and anchoring, play in perpetuating conflict, and how can awareness of these biases facilitate more effective conflict resolution strategies?

-

Were you surprised by the results? Do you agree with the results? How can you use this knowledge of your personal biases to inform your management strategies? How can the identified biases impact...

-

what ways do existing power structures perpetuate social stratification, and what are the socio-political ramifications of these dynamics ?

-

How do feedback loops and reflective practices contribute to continuous improvement and the refinement of teamwork dynamics over time ? Explain

-

What are the advantages and disadvantages of the ability to change objects in Ruby?

-

A researcher reports a significant two-way between-subjects ANOVA, F(3, 40) = 2.96. State the decision to retain or reject the null hypothesis for this test.

-

Green Thumb Garden Tools Inc. produces and sells home and garden tools and equipment. A lawnmower has a total cost of $ 230 per unit, of which $ 160 is product cost and $ 70 is selling and...

-

Green Thumb Garden Tools Inc. produces and sells home and garden tools and equipment. A lawnmower has a total cost of $ 230 per unit, of which $ 160 is product cost and $ 70 is selling and...

-

Green Thumb Garden Tools Inc. produces and sells home and garden tools and equipment. A lawnmower has a total cost of $ 230 per unit, of which $ 160 is product cost and $ 70 is selling and...

-

Series of Compound Interest Techniques The following are several situations involving compound interest. Required: Using the appropriate table, solve each of the following: ( Click here to access the...

-

If Clark Kelly has recognized gain on an exchange of like-kind property held for investment use, where does Clark report the gain? First on Form 8824, then carried to Schedule D. First on Form 8824,...

-

An investor put 40% of her money in Stock A and 60% in Stock B. Stock A has a beta of 1.2 and Stock B has a beta of 1.6. If the risk-free rate is 5% and the expected return on the market is 12%,...

Study smarter with the SolutionInn App