Foreign operations in a hyperinflationary economy Portasports, an EU firm, assembles and markets portable sports facilities

Question:

Foreign operations in a hyperinflationary economy Portasports, an EU firm, assembles and markets portable sports facilities – or ‘kits’. A kit allows sports matches – in, say, soccer, tennis or rugby – to be held in a village or town which lacks permanent facilities for that sport.

At the start of x3, Portasports establishes a subsidiary in the South Sea Islands (SSI). Portasports

(SSI) imports ‘portatennis’ kits from Europe. Each kit contains the key elements of a competition tennis court – ‘roll-away’ court with net, scoreboard and spectator stands.

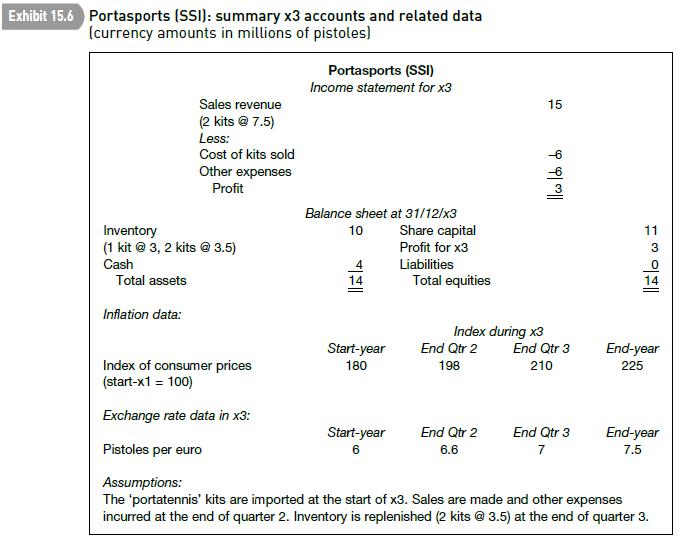

CHAPTER 15 • TRANSACTIONS AND OPERATIONS IN FOREIGN CURRENCIES 487 488 PART 2 • THE HOUSE OF ACCOUNTING Portasports (SSI)’s initial balance sheet is as follows (amounts are in millions of pistoles):

Balance sheet at 1/1/x3 Inventory 9 Share capital 11 Cash 2 Liabilities 0 Total assets 11 Total equities 11 The inventory consists of three kits costing 3 million pistoles (or A500,000) each.

Portasports (SSI) trades profitably in its first year. It sells two of the three kits. Its x3 accounts are shown in Exhibit 15.6, together with relevant exchange rate and inflation data.

The South Sea Islands have experienced a rapid increase in prices in recent years. The cumulative rate of increase in the three years to the end of x3 is 125%.

Required

(a) Convert Portasports (SSI)’s x3 accounts from pistoles into euros. Either restate the accounts into end-x3 constant purchasing power units and translate the restated accounts at the closing rate or translate the unadjusted accounts using the temporal method.

(b) Portasports records a translation loss of A0.16 million in its consolidated x3 accounts with respect to its SSI subsidiary. Suggest ways in which it can reduce or eliminate future translation losses using a natural hedge.AppenedixLO1

Step by Step Answer: