Intangible assets: from capitalisation to write-off Helius Software is a fast-growing company specialising in environmental management software.

Question:

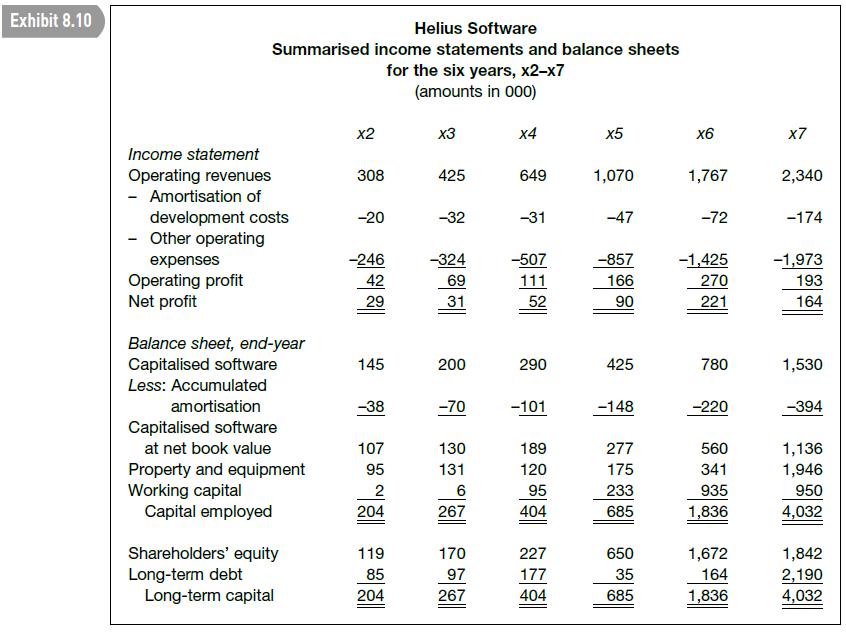

Intangible assets: from capitalisation to write-off Helius Software is a fast-growing company specialising in environmental management software.

Helius capitalises certain software development costs – in particular the costs of improving or extending existing software products – and amortises them over a 3–5 year period. Management are firm supporters of capitalisation. They maintain that the development costs they capitalise meet the definition of an asset and fulfil asset recognition criteria. They also claim that, if they had expensed such costs, the firm would not have grown as fast as it has. Raising capital, especially debt capital, would have been more difficult since the firm’s asset base would have been smaller.

Helius was founded in x1. Summary accounts for the six years from x2 to x7 are set out in Exhibit 8.10.

Required

(a) You discover that Helius’s competitors write off all software development costs as incurred. What would Helius’s operating profit and capital employed (fixed assets plus working capital) have been in the five years x3 to x7 if the firm had followed a similar policy of immediate write-off of development costs? Assume the change in accounting method has no effect on the income taxes the company pays.

(b) In the light of your answer to (a), suggest another reason why Helius’s management favour capitalisation.AppenedixLO1

Step by Step Answer: