Net-of-tax method: a simpler approach to deferred tax accounting? Why do we bother with deferred taxes? asks

Question:

Net-of-tax method: a simpler approach to deferred tax accounting?

‘Why do we bother with deferred taxes?’ asks the financial controller of a publicly quoted company.

‘None of our investors – or the analysts covering our company – appears to take any notice of the deferred tax component of income tax expense or of the deferred tax asset and liability on the balance sheet. They just focus on the company’s current tax expense and payable.

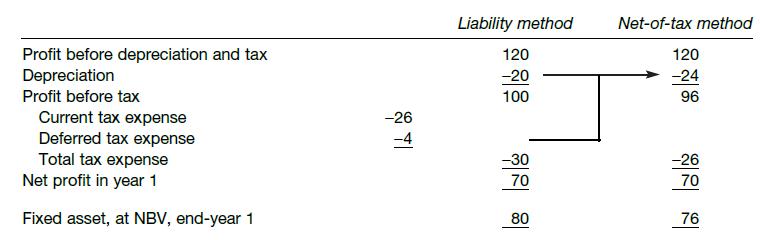

‘Maybe accounting rule-makers should abandon the liability method and require companies to use the net-of-tax method instead. Under this method, a company reports the tax effects of temporary differences as adjustments to the carrying amounts of particular assets and liabilities and the related revenues and expenses. So, for example, equipment would be shown on the balance sheet net of the tax effect of any temporary differences between its tax and book values. And the depreciation expense for that equipment would be adjusted for the deferred tax expense or benefit relating to that asset (i.e. the tax effect of the change in temporary difference). The tax expense figure in the income statement would comprise current tax payable only but net profit would not be affected. This can be seen in my example below. (I assume a fixed asset costing 100 with book depreciation of 20 and tax depreciation of 33 in the first year, profit before depreciation of 120 and a tax rate of 30%.)

So the net-of-tax depreciation charge consists of two elements – book depreciation of 20 plus the tax effect of the excess of tax over book depreciation of 4.

The main advantage of the net-of-tax method, in my view, is that the reported amount of an asset or liability incorporates the related tax benefit or cost directly. This gives a truer indication of its economic value. For example, the market value of the equipment described above is a function of both its service potential and the tax benefits available to the owner. In addition, the method simplifies the presentation of the income statement and balance sheet, removing the clutter of deferred tax items and making the accounts easier for a layperson to understand.’

Required Comment on the financial controller’s proposal. What are the potential weaknesses or disadvantages of the net-of-tax method, in your view?AppenedixLO1

Step by Step Answer: