Profitability: alternative ways of analysing ROE FKI is a UK-based engineering group with interests in automated material

Question:

Profitability: alternative ways of analysing ROE FKI is a UK-based engineering group with interests in automated material handling, lifting products, and energy technology (e.g. electrical generators, transformers and switchgear). Sales rose 30% in the 2000/01 financial year but operating profits only managed a 12% increase so margins slipped.

Summary income and balance sheet data from that year’s consolidated accounts are set out below.

All amounts are in £ millions.

Condensed profit and loss account for year to 31 March 2001 Turnover 1,740 Operating profit 202 Interest expense, net −44 Profit on ordinary activities before tax 158 Tax on profit on ordinary activities −55 Profit on ordinary activities after tax 103 Condensed balance sheet: average of end-March 2001 and 2000 figures Tangible fixed assets 398 Capital and reserves 443 Goodwill and other fixed assets 522 Long-term borrowings 663 920 Other long-term creditors and provisions 67 Stocks 249 730 Debtors 394 Short-term borrowings 18 Cash and short-term deposits 168 Trade and other short-term creditors 540 811 558 Total assets 1,731 Total equities 1,731 Required

(a) Calculate FKI’s return on equity for the year to 31 March 2001. Analyse ROE. What was the group’s profit margin, assets turnover and return on net operating assets in 2000/01? How much did it gain or lose from financial leverage that year? (Assume ‘Cash and short-term deposits’ are all financial assets. The UK corporate tax rate was 30% in 2000/01.)

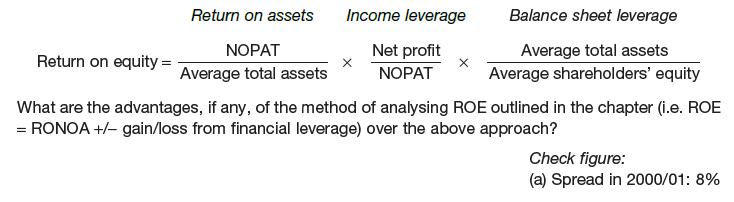

(b) Under an alternative approach, ROE is expressed as the product of return on assets and income and balance sheet leverage effects. The larger the interest expense in relation to net profit or the larger total liabilities in relation to total assets, the greater is the impact on ROE of these respective leverage effects.AppenedixLO1

Step by Step Answer: