Understanding cash flow terminology MetroModa is getting to be as laid back as its clothes. Operating working

Question:

Understanding cash flow terminology

‘MetroModa is getting to be as laid back as its clothes. Operating working capital soared by over A200 million in x1, absorbing cash needed for expansion and contributing to negative free cash flow that year.

The company has a great product line. If only its financial management were in the same league . . .’

MetroModa, a specialist designer and manufacturer of ‘smart casual’ clothes, is enjoying rapid growth, thanks to the movement towards less formal attire in the office. However, the company has attracted criticism among professional investors for its poor working capital management and high financial leverage.

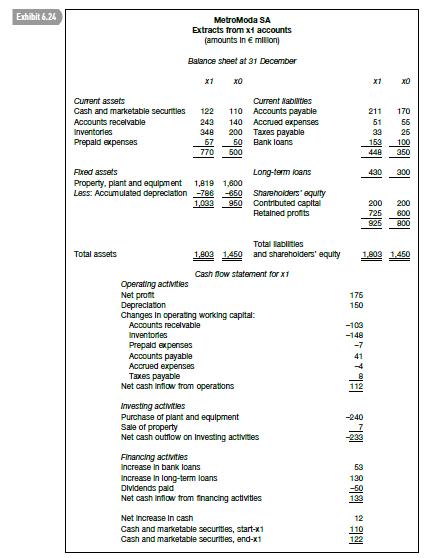

This criticism attracts the notice of the company’s non-executive directors. One of them saw the above comment in the Green Eye Shade column of the Business News, a prominent weekly newspaper, shortly after the company released its x1 results. He contacts the chief financial officer of the company and asks some questions (see below). The CFO is busy negotiating several acquisitions at present and, knowing your financial analysis skills, she asks you to deal with them. Extracts from MetroModa’s x1 accounts are given in Exhibit 6.24.

Required Answer the following questions raised by the non-executive director, using information in MetroModa’s x1 accounts.

(a) ‘How can working capital have increased by over A200 million in x1? By my calculations, working capital was A150 million at the end of x0 and A322 million at the end of x1. That’s an increase of only a172 million – a big increase, to be sure, but less than the figure quoted in Business News.’

(b) ‘What is “free cash flow”? It’s not stated anywhere on the cash flow statement. Is it the same as

“net increase in cash”? If so, this is a positive, not a negative, figure.’

(c) ‘Is the figure for depreciation in the cash flow statement correct? According to the balance sheet, depreciation was A786 million in x1. I assume that’s the number that should be in the cash flow statement.

It can’t be the change in depreciation between end-x0 and end-x1. That’s only A136 million.’AppenedixLO1

Step by Step Answer: