(Activity-based costing) Alaire Corporation manufactures several different types of printed circuit boards; however, two of the boards...

Question:

(Activity-based costing) Alaire Corporation manufactures several different types of printed circuit boards; however, two of the boards account for the majority of the company’s sales. The first of these boards, a television (TV) circuit board, has been a standard in the industry for several years. The market for this type of board is competitive and, therefore, price sensitive. Alaire plans to sell 65,000 of the TV circuit boards in 1997 at a price of $150 per unit. The second high- volume product, a personal computer (PC) circuit board, is a recent addition to Alaire’s product line. Because the PC board incorporates the latest technology, it can be sold at a premium price; the 1997 plans include the sale of 40,000 PC boards at $300 per unit.

Alaire’s management group is meeting to discuss strategies for 1997, and the current topic of conversation is how to spend the sales and promotion dollars for next year. The sales manager believes that the market share for the TV board could be expanded by concentrating Alaire’s promotional efforts in this area. In response to this suggestion, the production manager said, “Why don’t you go after a bigger market for the PC board? The cost sheets that I get show that the contribution from the PC board is more than double the contribution from the TV board. I know we get a premium price for the PC board; selling it should help overall profitability.”

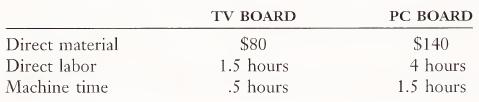

Alaire uses a standard cost system, and the following data apply to the TV and PC boards.

Variable factory overhead is applied on the basis of direct labor hours. For 1997, variable factory overhead is budgeted at $1,120,000, and direct labor hours are estimated at 280,000. The hourly rates for machine time and direct labor are $10 and $14, respectively. Alaire applies a material handling Charge at 10 percent of materials cost; this material handling charge is not included in variable factory overhead. Total 1997 expenditures for materials are budgeted at $10,600,000.

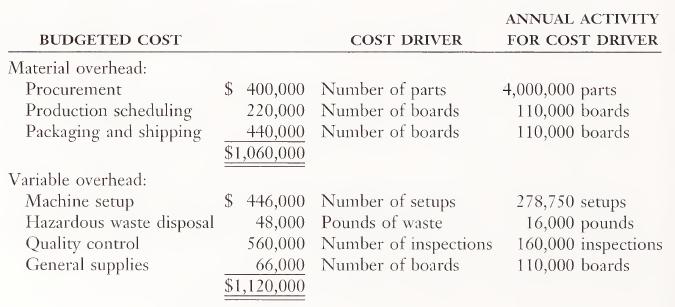

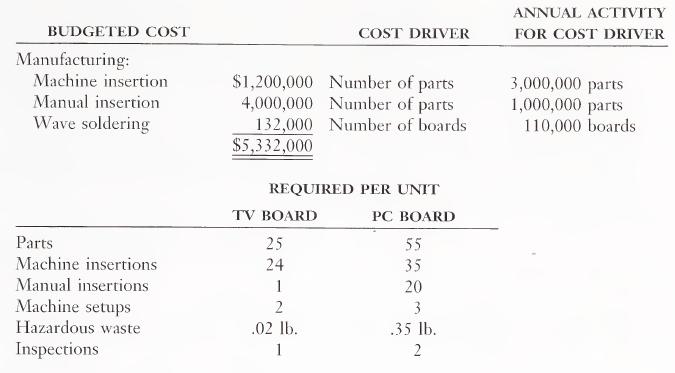

Ed Welch, Alaire’s controller, believes that before the management group proceeds with the discussion about allocated sales and promotional dollars to individual products, it might be worthwhile to look at these products on the basis of the activities involved in their production. As he explained to the group, “Activity-based costing integrates the cost of all activities, known as cost drivers, into individual product costs rather than including these costs in overhead pools.” Welch has prepared the following schedule to help the management group understand this concept.

“Using this information,” Welch explained, “we can calculate an activity- based cost for each TV board and each PC board and then compare it to the standard cost we have been using. The only cost that remains the same for both cost methods is the cost of direct materials. The cost drivers will replace the direct labor, machine time, and overhead costs in the standard cost.”

a. Identify at least four general advantages that are associated with activity- based costing.

b. On the basis of standard costs, calculate the total contribution expected in 1997 for Alaire Corporation’s 1. TV board. 2. PC board.

c. On the basis of activity-based costs, calculate the total contribution expected in 1997 for Alaire Corporation’s 1. TV board. 2. PC board.

d. Explain how the comparison of the results of the two costing methods may impact the decisions made by Alaire Corporation’s management group.

(CMA)

LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney