(Cash collections) Clark Inc. is preparing its first-quarter monthly cash bud get for 2006. The following information...

Question:

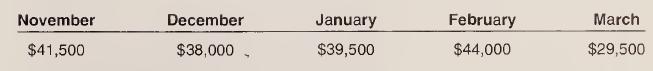

(Cash collections) Clark Inc. is preparing its first-quarter monthly cash bud¬ get for 2006. The following information is available about actual and ex-

pected sales:

Tracing collections from prior year monthly sales and discussions with the credit manager helped develop a profile of collection behavior patterns.

Of a given month’s sales, 40 percent is typically collected in the month of sale. Because the company terms are 1 percent (end of month) net 30, all collections within the month of sale are net of the 1 percent discount. Of a given month’s sales, 30 percent is collected in the month following the sale. The remaining 30 percent is collected in the second month following the month of the sale. Bad debts are negligible and should be ignored.

a. Prepare a schedule of cash collections for Clark Inc. by month for Janu¬ ary, February, and March.

b. Calculate the Accounts Receivable balance at March 31.LO.1

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn