(Cash flow) Shannon OLeary, the controller of Rosepetal Co., is disillusioned with the companys system of evaluating...

Question:

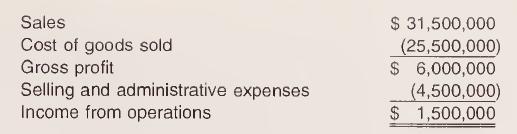

(Cash flow) Shannon O’Leary, the controller of Rosepetal Co., is disillusioned with the company’s system of evaluating the performance of divisional profit centers and their managers. The present system focuses on a comparison of budgeted to actual income from operations. Ms. O’Leary’s major concern with the current system is the ease with which profit center managers can manipulate the measure income from operations. Most corporate sales are made on credit and most purchases are made on account. The profit centers are organized according to product line. Following is Limerick Division’s second quarter 2007 income statement:

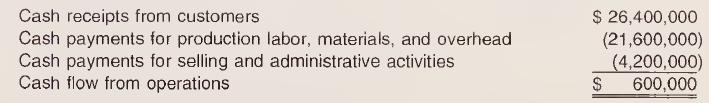

O’Leary has suggested that company management replace the accrual- based income from operations evaluation measure with a cash flow from operations measure. She believes this measure will be less susceptible to manipulation by profit center managers. To defend her position, she com¬ piles a cash flow income statement for the same profit center:

a. If O’Leary is correct about profit center managers manipulating the in¬ come measure, where are manipulations likely taking place?

b. Explain whether the proposed cash flow measure would be less subject to manipulation than the income measure.

C. Explain whether manipulation would be reduced if both the cash flow and income measures were utilized.

d. Do the cash and income measures reveal different information about profit center performance? Explain.

e. How could the existing income statement be used more effectively in evaluating performance?

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn