Cherrington Company wants to earn $420,000 in net (after-tax) income next year. Its product is priced at

Question:

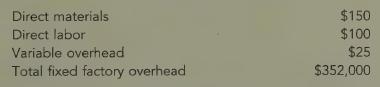

Cherrington Company wants to earn $420,000 in net (after-tax) income next year. Its product is priced at $480 per unit. Product costs include:

Variable selling expense is $45 per unit; fixed selling and administrative expense totals $340,000. Cherrington has a tax rate of 30 percent.

Required:

1. Calculate the before-tax profit needed to achieve an after-tax target of $420,000.

2. Calculate the number of units that will yield operating income calculated in Requirement | above.

3. Prepare an income statement for Cherrington Company for the coming year based on the number of units computed in Requirement 2.

4. What if Cherrington had a 35 percent tax rate? Would the units sold to reach a $420,000 target net income be higher or lower than the units calculated in Requirement 3? Calculate the number of units needed at the new tax rate.LO1

Step by Step Answer:

Introduction To Cost Accounting

ISBN: 9780538749633

1st International Edition

Authors: Don R. Hansen, Maryanne Mowen, Liming Guan, Mowen/Hansen