(Convert variable to absorption) Jenny Lowe started a new business in 1996 to produce portable, climate-controlled shelters....

Question:

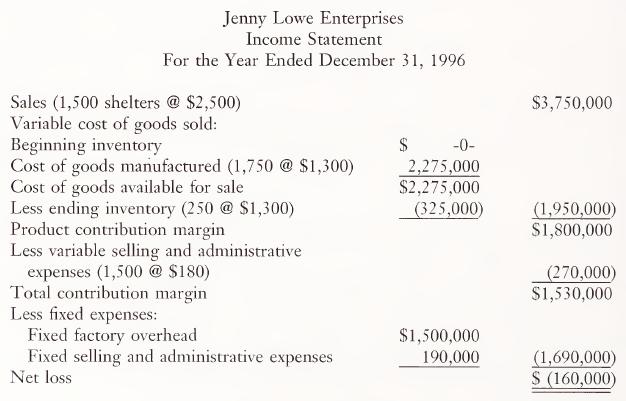

(Convert variable to absorption) Jenny Lowe started a new business in 1996 to produce portable, climate-controlled shelters. The shelters have many applica¬ tions in special events and sporting activities. Jenny’s accountant prepared the following variable costing income statement after the first year to help her in making decisions.

During the year, the following variable production costs per unit were recorded: direct material, $800; direct labor, $300; and overhead, $200.

Ms. Lowe was upset about the net loss because she had wanted to borrow funds to expand capacity. Her friend who teaches accounting at a local university suggested that the use of absorption costing could change the picture.

a. Prepare an absorption costing pretax income statement.

b. Explain the source of the difference between the net income and the net loss figures under the two costing systems.

c. Would it be appropriate to present an absorption costing income statement to the local banker in light of Ms. Lowe’s knowledge of the net loss deter¬ mined under variable costing? Explain.

d. Assume that during the second year of operations, Ms. Lowe’s company produced 1,750 shelters, sold 1,850, and experienced the same total fixed costs. 1. Prepare a variable costing pretax income statement. 2. Prepare an absorption costing pretax income statement. 3. Explain the difference between the incomes for the second year under the two systems.

LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney