(Convert variable to absorption) Philip Barnes, vice president of marketing for At lantic Gifts, has just received...

Question:

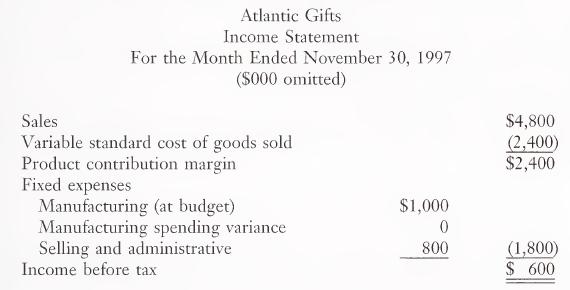

(Convert variable to absorption) Philip Barnes, vice president of marketing for At¬ lantic Gifts, has just received the November 1997 income statement, shown below, which was prepared on a variable costing basis. The firm uses a variable costing system for internal reporting purposes.

The controller attached the following notes to the statements:

The unit sales price for November averaged $48.

The standard unit manufacturing costs for the month were:

The unit rate for fixed manufacturing costs is a predetermined rate based on a normal monthly production of 100,000 units. Production for November was 5,000 units in excess of sales, and the November ending inventory consisted of 8,000 units.

a. The vice president of marketing is not comfortable with the variable cost basis and wonders what income before tax would have been under the prior basis (absorption costing). 1. Present the November income statement on an absorption costing basis. 2. Reconcile and explain the difference between the variable costing and the absorption costing income figures.

b. Explain the features associated with variable cost income measurement that should be attractive to the vice president of marketing.

LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney