(CVP analysis) Susan Katz owns the Holiday Litter Box, a luxury hotel for dogs and cats. The...

Question:

(CVP analysis) Susan Katz owns the Holiday Litter Box, a luxury hotel for dogs and cats. The capacity is 40 pets: 20 dogs and 20 cats. Each pet has an air- conditioned room with a window overlooking a garden. Soft music is played continuously. Pets are awakened at 7 A.M., served breakfast at 8 A.M., fed snacks at 3:30 P.M., and receive dinner at 5 P.M. Hotel services also include airport pickup, daily bathing and grooming, night lighting in each suite, carpeted floors, and daily play visits by pet “babysitters.”

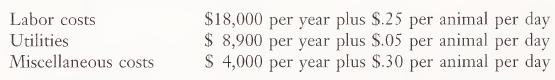

Pet owners are interviewed about their pets’ health-care requirements, likes and dislikes, diet, and other needs. Reservations are essential and health must be documented by each pet’s veterinarian. The costs of operating the pet hotel are substantial. The hotel’s original cost was $85,000. Depreciation is $6,000 per year. Other costs of operating the hotel include:

In addition to these costs, costs are incurred for food and water for each pet. These costs are strictly variable and (on average) run $2.00 per day for dogs and $.75 per day for cats.

a. Assuming that the hotel is able to maintain an average annual occupancy of 75 percent in both the cat and the dog units (based on a 360-day year), determine the minimum daily charge that must be assessed per animal day to generate $12,000 of income before taxes.

b. Assume that the price Susan charges cat owners is $10 per day and the price charged to dog owners is $12 per day. If the sales mix is 1 to 1 (one cat day of occupancy for each dog day of occupancy) compute the following: 1. The break-even point in total occupancy days. 2. Total occupancy days required to generate $20,000 of income before tax. 3. Total occupancy days to generate $20,000 of after-tax income; Susan’s personal tax rate is 35 percent.

c. Susan is considering adding an animal training service for guests to comple¬ ment her other hotel services. Susan has estimated the costs of providing such a service would largely be fixed. Because all of the facilities already exist, Susan would merely need to hire a dog trainer. She estimates a dog trainer could be hired at a cost of $25,000 per year. If Susan decides to add this service, how much would her daily charges have to increase (assume equal dollar increases to cat and dog fees) to maintain the break-even level you computed in part b?

LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney