CVP; DOL; MStwo quarters; comprehensive) Following is information per taining to Tigers Companys operations of the first

Question:

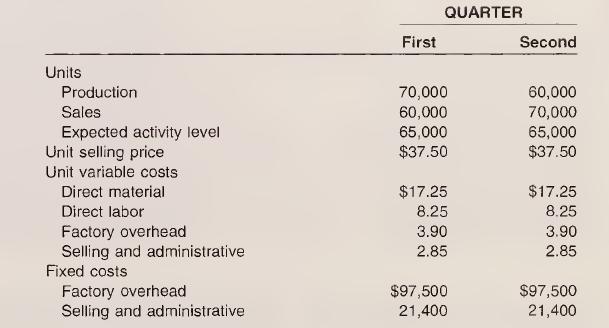

CVP; DOL; MS—two quarters; comprehensive) Following is information per¬ taining to Tigers Company’s operations of the first and second quarter of 2007:

Additional Information • There were no beginning/ending finished goods at January 1, 2007.

• Tigers writes off any quarterly underapplied or overapplied overhead as an adjustment to Cost of Goods Sold.

• Tigers’ income tax rate is 35 percent.

a. Prepare a variable costing income statement for each quarter.

b. Calculate each of the following for 2007 if 260,000 units were produced and sold:

1. Unit contribution margin.

2. Contribution margin ratio.

3. Total contribution margin.

4. Net income.

5. Degree of operating leverage.

6. Annual break-even unit sales volume.

7. Annual break-even dollar sales volume.

8. Annual margin of safety as a percentage.

9. Annual margin of safety in units.

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn