(Development of OH rates) Northcoast Manufacturing Company, a small manu facturer of parts used in appliances, has...

Question:

(Development of OH rates) Northcoast Manufacturing Company, a small manu¬ facturer of parts used in appliances, has just completed its first year of operations. The company’s controller, Vic Trainor, has been reviewing the actual results for the year and is concerned about the application of factory overhead. Trainor is using the following information to assess operations.

• Northcoast’s equipment consists of several machines with a combined cost of $2,200,000 and no residual value. Each machine has an output of five units of product per hour and a useful life of 20,000 hours.

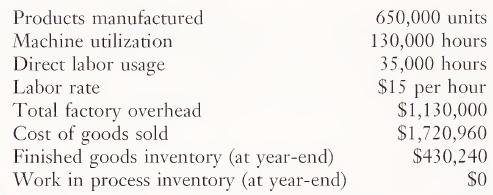

* Selected annual data of Northcoast’s operations for the year just ended are as follows:

* Total factory overhead is applied to products on a direct labor cost basis using a predetermined plantwide rate.

• The budgeted activity for the year included 20 employees each working 1,800 productive hours per year to produce 540,000 units of product. The machines are highly automated, and each employee can operate two to four machines simultaneously. Normal activity is for each employee to operate three ma¬ chines. Machine operators are paid $15 per hour.

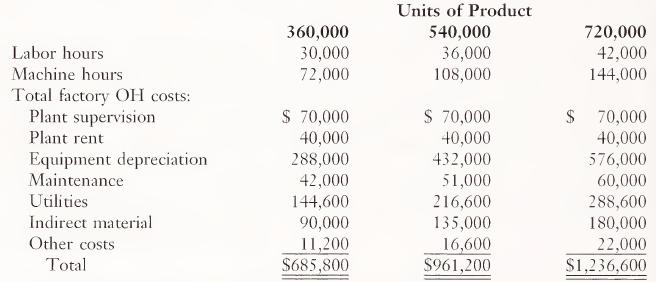

■ Budgeted factory overhead costs for the past year for various levels of activity are as follows:

a. Based on Northcoast Manufacturing Company’s actual operations for the past year, 1. determine the dollar amount ol total underapplied or overapplied factory overhead and explain why this amount is material. 2. prepare the appropriate journal entry to close out Northcoast’s total fac¬ tory overhead account.

b. Vic Trainor believes that Northcoast Manufacturing Company should be using machine hours to apply total factory overhead. Using the data given, 1. determine the dollar amount of total underapplied or overapplied factory overhead if machine hours had been used as the application base. 2. explain why machine hours would be a more appropriate application base.

LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney