Douglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels

Question:

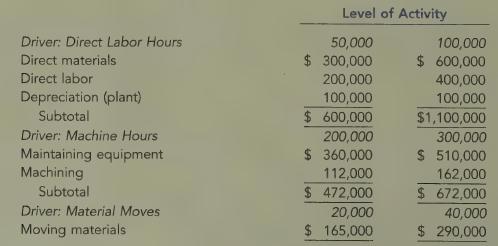

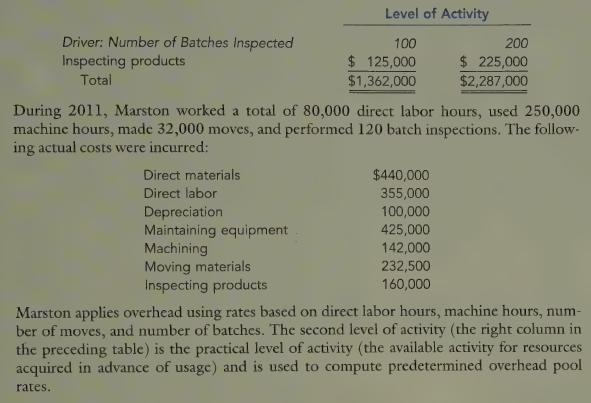

Douglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 2011:

Required:

1. Prepare a performance report for Marston’s manufacturing costs in 2011.

2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost.

3. One of Marston’s managers said the following: “Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output 1s reported. We have four forklifts, each capable of providing 10,000 moves per year.

We lease these forklifts for five years, at $10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of $30,000 per year. Also, I know that fuel costs about $0.25 per move.”

Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities. )LO1

Step by Step Answer:

Introduction To Cost Accounting

ISBN: 9780538749633

1st International Edition

Authors: Don R. Hansen, Maryanne Mowen, Liming Guan, Mowen/Hansen