Garrity Food Products Company manufactures canned mixed nuts with an average manufacturing cost of $48 per case

Question:

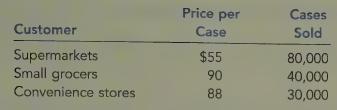

Garrity Food Products Company manufactures canned mixed nuts with an average manufacturing cost of $48 per case (a case contains 24 cans of nuts). Garrity sold 150,000 cases last year to the following three classes of customer:

The supermarkets require special labeling on each can costing $0.03 per can. They order through electronic data interchange (EDI), which costs Garrity about $50,000 annually in operating expenses and depreciation. Garrity delivers the nuts to the stores and stocks them on the shelves. This distribution costs $50,000 per year.

The small grocers order in smaller lots that require special picking and packing in the factory; the special handling adds $20 to the cost of each case sold. Sales commissions to the independent jobbers who sell Garrity products to the grocers average 10 percent of sales. Bad debts expense amounts to 8 percent of sales.

Convenience stores also require special handling that costs $30 per case. In addition, Garrity is required to co-pay advertising costs with the convenience stores at a cost of $15,000 per year. Frequent stops are made to each convenience store by Garrity delivery trucks at a cost of $30,000 per year.

Required:

1. Calculate the total cost per case for each of the three customer classes.

2. Using the costs from Requirement 1, calculate the profit per case per customer class. Does the cost analysis support the charging of different prices? Why or why not?

3. What if Garrity charged the average price per case to all customer classes? How would that affect the profit percentages?LO1

Step by Step Answer:

Introduction To Cost Accounting

ISBN: 9780538749633

1st International Edition

Authors: Don R. Hansen, Maryanne Mowen, Liming Guan, Mowen/Hansen