(JIT journal entries; advanced) Hanson Products has implemented a just-in- time inventory system for the production of...

Question:

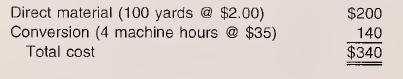

(JIT journal entries; advanced) Hanson Products has implemented a just-in- time inventory system for the production of its insulated wire. Inventories of raw material and work in process are so small that Hanson uses a Raw and In-Process account. In addition, almost all labor operations are automated, and Hanson has chosen to cost products using standards for direct material and conversion. The following production standards are applicable at the beginning of 2006 for one roll of insulated wire:

The conversion cost of $35 per machine hour was estimated on the basis of 500,000 machine hours for the year and $17,500,000 of conversion costs.

The following activities took place during 2006:

1. Raw material purchased and placed into production totaled 12,452,000 yards. All except 8,000 yards were purchased at the stan¬ dard price of $2.00 per yard. The other 8,000 yards were purchased at a cost of $2.06 per yard due to the placement of a rush order. The or¬ der was approved in advance by management. All purchases are on account.

2. From January 1 to February 28, Hanson manufactured 20,800 rolls of in¬ sulated wire. Conversion costs incurred to date totaled $3,000,000. Of this amount, $600,000 was for depreciation, $2,200,000 was paid in cash, and $200,000 was on account.

3. Conversion costs are applied to the Raw and In-Process account from January 1 to February 28 on the basis of the annual standard.

4. The Engineering Department issued a change in the operations flow document effective March 1, 2006. The change decreased the machine time to manufacture one roll of wire by 5 minutes per roll. However, the standard raised the amount of direct material to 100.4 yards per roll. The Accounting Department requires that the annual standard be contin¬ ued for costing the Raw and In-Process Inventory for the remainder of 2006. The effects of the engineering changes should be shown in two accounts: Material Quantity Engineering Change Variance and Machine Hours Engineering Change Variance.

5. Total production for the remainder of 2006 was 103,200 rolls of wire. Total conversion costs for the remaining 10 months of 2006 were $14,442,000. Of this amount, $4,000,000 was depreciation, $9,325,000 was paid in cash, and $1,117,000 was on account.

6. The standard amount of conversion cost is applied to the Raw and In- Process Inventory for the remainder of the year.

Note: Some of the journal entries for the following items are not explicitly covered in the chapter. This problem challenges students regarding the ac¬ counting effects of the implementation of a JIT system.

a. Prepare entries for items 1, 2, 3, 5, and 6.

b. Determine the increase in material cost due to the engineering change related to direct material.

c. Prepare a journal entry to adjust the Raw and In-Process Inventory ac¬ count for the engineering change cost found in part (b).

d. Determine the reduction in conversion cost due to the engineering change related to machine time.

e. Prepare a journal entry to reclassify the actual conversion costs by the savings found in part (d).

f. Making the entry in part

(e) raises conversion costs to what they would have been if the engineering change related to machine time had not been made. Are conversion costs under- or overapplied and by what amount?

g. Assume that the reduction in machine time could not have been made without the corresponding increase in material usage. Is the net effect of these engineering changes cost beneficial? Why?

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn