(Life cycle costing) The Products Development Division of Extralite Cuisine has just completed its work on a...

Question:

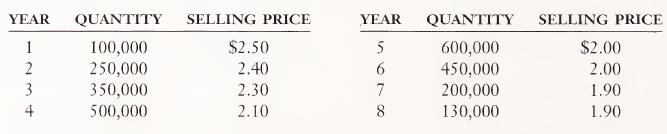

(Life cycle costing) The Products Development Division of Extralite Cuisine has just completed its work on a new microwave entree. The marketing group has decided on a very high original price for the entree, but the selling price will be reduced as competitors appear. Market studies indicate that the following quan¬ tities of the product can be sold at the following prices over its life cycle:

Development costs plus other startup costs for dais product will total $600,000. Engineering estimates of direct materials and direct labor costs are $.85 and $.20 per unit. These costs can be held constant for approximately 4 years and in year 5 will each increase by 10 percent. Variable overhead per unit is expected to be $.25, and fixed overhead is expected to be $100,000 per year. Extralite Cuisine management likes to earn a 20 percent gross margin on products of this type.

a. Prepare an income statement for each year of the product’s life, assuming all product costs are inventoried and using 8-year straight-line depreciation of the development and startup costs. What is the cost per unit each year? What rate of gross margin will the product generate each year?

b. Determine the gross margin to be generated by this product over its life. What rate of gross margin is this?

c. Discuss the differences in the information provided by the analyses in parts a and b.

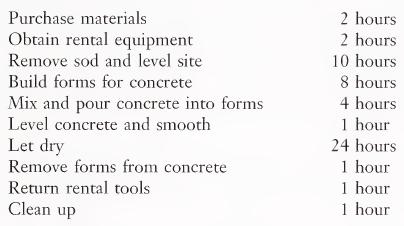

43.(Identifying non-value-added activities) Donna Muniz is planning to build a patio in back of her home during her annual vacation. She has prepared the following schedule of how her time on the patio project will be allocated:

a. Identify the value-added activities. How much total time is value-added?

b. Identify the non-value-added activities. How much total time is spent per¬ forming non-value-added activities?

c. Calculate the manufacturing cycle efficiency.

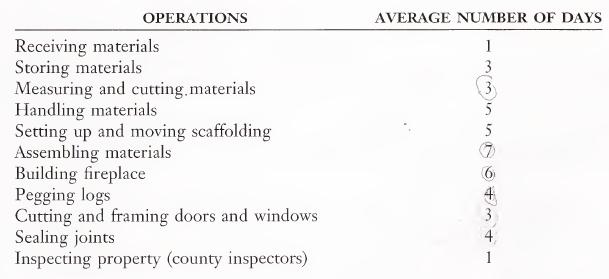

44.(Activity analysis; MCE) Dan’l Boone Homes constructs log cabin vacation houses in the Tennessee mountains for customers. As the company’s consultant, you developed the following value chart:

a. What are the value-added activities and their total time?

b. What are the non-value-added activities and their total time?

c. Calculate the manufacturing cycle efficiency of the process.

d. Prepare a one-minute presentation explaining the difference between value- added and non-value-added activities.

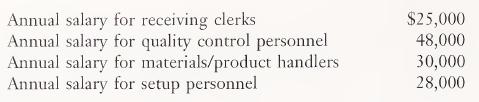

45.(Cost of non-value-added activities) Refer to the value chart shown in Exhibit 6-8. Jennifer Chaix, the company president, asked her cost accountant for the fol¬ lowing information to help determine the total cost of non-value-added activities for one lot of the company’s product.

Each unit requires 1 square foot of storage space in a storage building containing 100,000 square feet. Depreciation per year on the building is $125,000 and property taxes and insurance total $35,000. Assume a 365-day year for plant assets and a 240-day year for personnel. Where a range of time is indicated, assume an average. Waiting time cost can be estimated at $50 per batch per day. Each day of delay in customer receipt is estimated to cost $150 per unit per day. The average production lot size is 500 units.

Determine the total cost of non-value-added activities per unit per day for each lot.LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney