(NPV; PI; sensitivity analysis) Norton Industries is considering reengineering its manufacturing operations to replace certain manual operations...

Question:

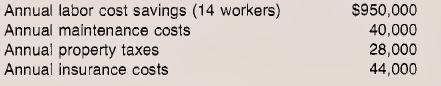

(NPV; PI; sensitivity analysis) Norton Industries is considering reengineering its manufacturing operations to replace certain manual operations with auto¬ mated equipment. The new equipment would have an initial cost of $5,000,000 including installation. The vendor has indicated that the equip¬ ment has an expected life of seven years with an estimated salvage value of $400,000. Estimates of annual labor savings and incremental costs associated with operating the new equipment follow;

a. Assuming the company’s cost of capital is 8 percent, compute the NPV of the investment in the automated equipment. (Ignore taxes.)

b. Based on the NPV, should the company invest in the new equipment?

C. Compute the profitability index for this potential investment. (Ignore taxes.)

d. Assume that of the estimates its management has made, Norton is least confident of the labor cost savings. Calculate the minimum annual labor savings that must be realized for the project to be financially acceptable.

e. What other qualitative factors should the company consider in evaluating this investment? LO.1

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn