(NPV; project ranking: risk) Ellsworth Engineering is expanding operations, and the firms president, Jimmy James, is trying...

Question:

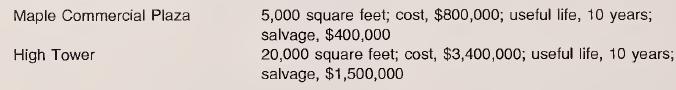

(NPV; project ranking: risk) Ellsworth Engineering is expanding operations, and the firm’s president, Jimmy James, is trying to make a decision about new office space. The following are James’ options:

If the company purchases Maple Commercial Plaza, it will occupy all of the space. If it purchases High Tower, it will rent the extra space for $620,000 per year. Both buildings will be depreciated on a straight-line basis. For tax purposes, the buildings will be depreciated using a 25-year life. Purchasing either building will save the company $210,000 annually in rental payments. All other costs of the two options (such as land cost) are expected to be the same. The firm’s tax rate is 40 percent.

a. Determine the before-tax net cash flows from each project for each year.

b. Determine the after-tax cash flows from each project for each year.

c. Determine the net present value for each project if the cost of capital for Ellsworth Engineering is 11 percent. Which purchase is the better in¬ vestment based on the NPV method?

d. James is concerned about the ability to rent out the excess space in High Tower for the 10-year period. To compute the NPV for that por¬ tion of the project’s cash flows, he has decided to use a discount rate of 20 percent to compensate for risk. Compute the NPV and determine which investment is more acceptable. LO.1

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn