Prepare a close-out log for the hotel case study. Include at least ten subcontractor and supplier categories.

Question:

Prepare a close-out log for the hotel case study. Include at least ten subcontractor and supplier categories. Make whatever assumptions are necessary.

Hotel Case Study:

Many additional elements are necessary to complete the construction cost estimate. An estimate summary page will be utilized to gather all of the direct work estimates, subcontractor pricing, general conditions, and markups. An estimate summary form, similar to other estimating forms, should be developed and used uniformly throughout the firm. It may require slight modification for any one project but its consistency is important to provide the project estimating team with a quick and comfortable overview prior to and during bid day. With all estimating, construction management, and cost accounting forms, consistency is important throughout any construction firm. Consistency helps reduce errors and therefore improves productivity and profits.

In the case of a bid job, the estimate summary should be filled out as much as possible the day prior to bid day. A pre bid-day estimate summary should be prepared as a refinement of the first rough-order-of-magnitude estimate that was developed the day the bid or proposal documents came into the contractor’s office. As the estimator works to complete the estimate, he or she should use the most current and relevant pricing information. All of the pricing recap pages are brought forward by posting the values on the summary sheet. The estimator should have someone else check the math as it is here that many gross errors may occur. The computer is an excellent and standard tool to use at this time and throughout the estimating process. Printing hard copies may seem archaic to some in the technology age, but often this is only where blatant errors may literally ‘jump off the page’ at the estimator and/or his or her superiors.

On the bottom of the estimate summary, below the subtotal of the direct, indirect, and subcontracted costs, are a series of percentage markups including the fee. The fee is comprised of home office overhead and profit, or ‘OH&P’. Home office overhead costs include items such as accounting, marketing, and officer salaries. These costs usually are a relatively fixed figure based upon staffing for one fiscal year. An average-sized general contractor may need to generate a minimum fee of 1% to 4% (that is 1% to 4% of their total annual volume) to cover these costs. In addition to covering the indirect costs, the contractor desires to earn a profit on each project. The desired profit plus the home office overhead indirect cost is the fee. Fees can range anywhere from 2.5% to 7.5% for commercial work and often 10% and higher for civil and residential projects due to the increased direct labor risk. Smaller commercial contractors also require higher fees on their projects due to smaller annual volumes. If the GC self-performs much of the work, they also have a proportional increased risk and require a higher fee. On cost-plus contracts, conceptual cost estimates may be used to establish the guaranteed maximum price, but home office overhead costs still need to be estimated to develop the fee proposal. There are many percentage add-on markups which will show up on any estimating summary page. The type of contractor (subcontractor, supplier, commercial GC, civil, residential) also affects which markups and percentages are appropriate. Follows are a few of the more common ones:

Labor burden is not really a markup but is a cost of the work, especially direct work.Contractors which use loaded wages will include burden above the subtotal line with thework and others will factor it below the line with the balance of the other markups.

General liability insurance is volume related. The insurance rate will vary significantly betweencontractors depending upon their size and safety records. This markup generally ranges from lessthan 1% for large commercial and civil contractors to 2% for smaller GCs and subcontractors.

Taxes, including material sales tax, business tax, or excise tax should be job-costed but aredependent upon the city, county, and state.

If the project is competitively bid with relatively complete documents, the amount of contingency applied is usually zero. Most GCs account for the contingency, if any, with their choiceof fee on competitive projects. Stated contingencies will show up on negotiated projects which have incomplete documents.

Performance and payment bond rates are also annual volume and company performancerelated but the project bond costs are project-specific. They generally do not appear on negotiated projects. On larger lump sum projects, they may be required, especially for public andcivil work, and the cost will range dependent upon the size of the project and the past performance of the contractor. The bond cost is customarily ‘below-the-line,’ that is below the basebid, or is an alternate add-on and not included in the quote in a lump sum bid.

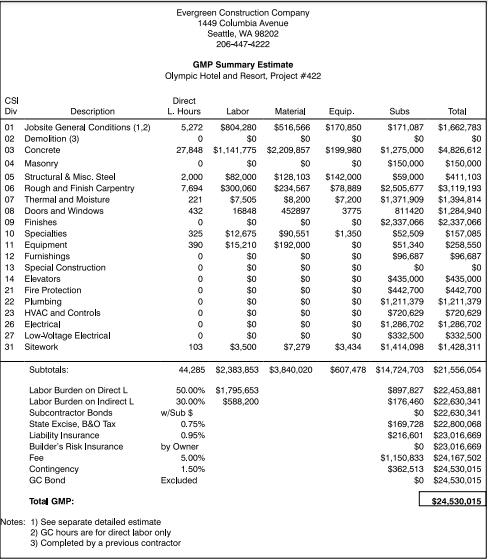

The focus of upcoming Chapter 6 is on home office overhead and profit, which equals the fee. Some of these other markups will be discussed there as well. The final bid or proposal value is determined on bid day. This is the final step in Estimating Process Figure 4.1. Subcontractor quotations will be received, plugs will be removed, and the pre bid-day budget totals revised and replaced with hard bid quotes. The final bid generally is approved by the officer-in-charge of the construction firm. The total figure must be submitted on the form specified in the instructions to bidders to the client before the specified bid time. A summary estimate for the Olympic Hotel case study is shown in Figure 4.5. A detailed ten-page estimate is included on the eResource.

Figure 4.5:

Step by Step Answer:

Cost Accounting And Financial Management For Construction Project Managers

ISBN: 9781138550650

1st Edition

Authors: Len Holm