(Preparing a cash budget) Collegiate Management Education (CME), Inc., is a nonprofit organization that sponsors a wide...

Question:

(Preparing a cash budget) Collegiate Management Education (CME), Inc., is a nonprofit organization that sponsors a wide variety of management seminars throughout the Southwest. In addition, it is heavily involved in research into improved methods of teaching and motivating college administrators. The sem¬ inar activity is largely supported by fees, and the research program is supported from membership dues.

CME operates on a calendar year basis and is finalizing the budget for 1997. The following information has been taken from approved plans, which are still tentative at this time:

SEMINAR PROGRAM Revenue—The scheduled number of programs should produce $12,000,000 of revenue for the year. Each program is budgeted to produce the same amount of revenue. The revenue is collected during the month the program is offered. The programs are scheduled during the basic academic year and are not held during June, July, August, and December. Twelve percent of the revenue is generated in each of the first 5 months of the year and the remainder is distributed evenly during September, October, and November.

Direct expenses—The seminar expenses are made up of three types:

» Instructors’ fees are paid at the rate of 70 percent of seminar revenue in the month following the seminar. The instructors are considered independent contractors and are not eligible for CME employee benefits.

■ Facilities fees total $5,600,000 for the year. They are the same for each pro¬ gram and are paid in the month the program is given.

■ Annual promotional costs of $1,000,000 are spent equally in all months except June and July when there is no promotional effort.

RESEARCH PROGRAM Research grants—The research program has a large number of projects nearing completion. The main research activity this year includes feasibility studies for new projects to be started in 1998. As a result, the total grant expense of $3,000,000 for 1997 is expected to be paid out at the rate of $500,000 per month during the first 6 months of the year.

SALARIES AND OTHER CME EXPENSES ® Office lease—Annual amount of $240,000 paid monthly at the beginning of each month.

■ General administrative expenses—$1,500,000 annually or $125,000 per month. These are paid in cash as incurred.

■ Depreciation expense—$240,000 per year.

* General CME promotion—annual cost of $600,000, paid monthly.

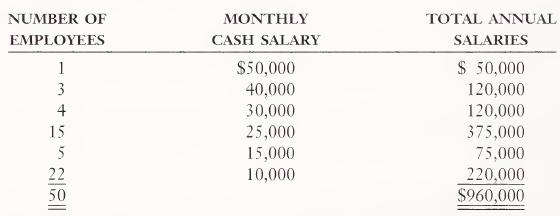

■ Salaries and benefits are as follows:

Employee benefits amount to $240,000 or 25 percent of annual salaries. Except for the pension contribution, the benefits are paid as salaries are paid. The annual pension payment of $24,000, based on 2.5 percent of total annual salaries, is due on April 15, 1997.

OTHER INFORMATION ■ Membership income—CME has 100,000 members who each pay an annual fee of $100. The fee for the calendar year is invoiced in late June.

* The collection schedule is as follows: July, 60 percent; August, 30 percent; September, 5 percent; and June, 5 percent.

■ Capital expenditures—The capital expenditures program calls for a total of $510,000 in cash payments to be spread evenly over the first 5 months of 1997.

■ Cash and temporary investments at January 1, 1997, are estimated at $750,000.

a. Prepare a budget of the annual cash receipts and disbursements for 1997.

b. Prepare a cash budget for CME for January 1997.

c. Using the information developed in parts a and

b, identify two important operating problems of CME.

(CMA adapted)LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney