Product line) Operations of Tanner Oil Drilling Services are separated into two geographical divisions: United States and

Question:

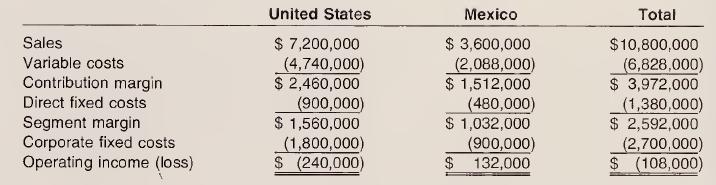

Product line) Operations of Tanner Oil Drilling Services are separated into two geographical divisions: United States and Mexico. The operating results of each division for 2006 follow.

Corporate fixed costs are allocated to the divisions based on relative sales. Assume that all of a division’s direct fixed costs could be avoided by eliminating that division. Because the U.S. Division is operating at a loss, Tanner’s president is considering eliminating it.

a. If the U.S. Division had been eliminated at the beginning of the year, what would have been Tanner’s pre-tax income?

b. Recast the income statements into a more meaningful format than the one given. Why would total corporate operating results go from a $108,000 loss to the results determined in part (a)?

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn