(Production; purchases; cash budgets) King Hats expects sales and collec tions for the first three months of...

Question:

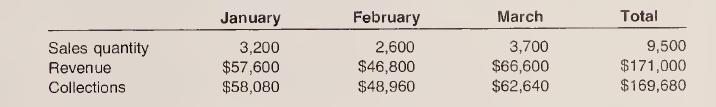

(Production; purchases; cash budgets) King Hats expects sales and collec¬ tions for the first three months of 2006 to be as follows:

The December 31, 2005, balance sheet revealed the following selected ac¬ count balances: Cash, $18,760; Raw Materials Inventory, $3,812.50; Finished Goods Inventory, $10,500; and Accounts Payable, $3,800. The Raw Materials Inventory balance represents 457.50 yards of felt and 12,200 inches of rib¬ bon. The Finished Goods Inventory consists of 800 hats.

Ending finished goods inventory should be sufficient to satisfy 25 per¬ cent of the subsequent month’s sales. In this regard, the company predicts both production and sales of 3,600 hats in April. King Corp. completes all work in the month it is started; so, no work in process exists.

Each hat requires 3/4 of a yard of felt and 20 inches of ribbon. Felt costs $5 per yard, and ribbon costs $0.15 per inch. Ending inventory policy for raw materials is 20 percent of the next month’s production.

The company normally pays for 80 percent of a month’s purchases of raw materials in the month of purchase (on which it takes a 2 percent cash discount). The remaining 20 percent is paid in full in the month following the month of purchase.

Direct labor is budgeted at $4 per hat produced and is paid in the month of production. Total out-of-pocket factory overhead can be predicted as $5,200 per month plus $1.25 per hat produced. Total nonfactoiy cash costs equal $2,800 per month plus 10 percent of sales revenue. All factory and nonfactory cash expenses are paid in the month of incurrence. In addi¬ tion, the company plans to make an estimated quarterly tax payment of $5,000 and pay executive bonuses of $15,000 in January 2006.

Management wants to have a minimum cash balance of $12,000 at the end of each month. If the company has to borrow funds, it will do so in $1,000 multiples at the beginning of a month at a 12 percent annual interest rate. Loans are to be repaid at the end of a month in multiples of $1,000. Interest is paid only when a repayment is made. Investments are made in $1,000 multiples at the end of a month, and interest is earned at 8 percent per year.

a. Prepare a production budget by month and in total for the first quarter of 2006.

b. Prepare a raw material purchases budget by month and in total for the first quarter of 2006.

C. Prepare a schedule of cash payments for purchases by month and in to¬ tal for the first quarter of 2006. The Accounts Payable balance on De¬ cember 31, 2005, represents the unpaid 20 percent of December purchases.

d. Prepare a combined payments schedule for factory overhead and nonfac¬ tory cash costs for each month and in total for the first quarter of 2006.

e. Prepare a cash budget for each month and in total for the first quarter of 2006.LO.1

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn