(Profit center performance) Mitchell Hardy, head of the accounting depart ment at Hill Country College, has felt...

Question:

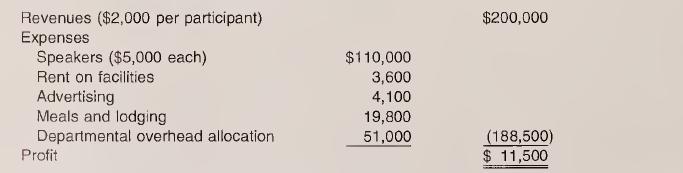

(Profit center performance) Mitchell Hardy, head of the accounting depart¬ ment at Hill Country College, has felt increasing pressure to raise external funds to compensate for dwindling state financial support. He decided to of¬ fer a three-day accounting workshop on income taxation for local CPAs in late February 2007. Jane Bennett, a tenured tax professor, offered to super¬ vise the seminar’s planning process. In mid-January, Bennett presented to Hardy the following profit budget:

The following explains the budget: The $3,600 facilities rent is a fixed rental which is to be paid to a local hotel for the use of its meeting rooms. Advertising is also a fixed cost. Meal expense is budgeted at $7 per person per meal (a total of nine meals to be provided for each participant); lodging is budgeted at the rate of $45 per participant per night. The departmental overhead includes a $10 charge per participant for supplies as well as a general allocation of 25 percent of revenues for use of departmental secre¬ tarial and production resources. After reviewing the budget, Hardy gave Bennett approval to proceed with the seminar.

a. Recast the budget in a segment margin income statement format.

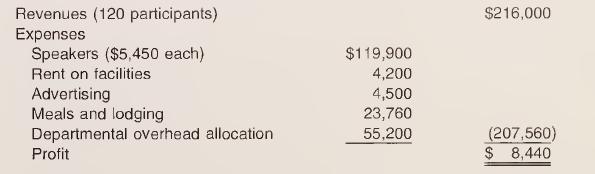

b. The seminar’s actual financial results were as follows:

Because signups were below expectations, the seminar fee was reduced from $2,000 to $1,800 and advertising expense was increased. In budget¬ ing for the speakers, Bennett neglected to include airfare, which aver¬ aged $450 per speaker. With the increased attendance, a larger meeting room had to be rented from the local hotel. Recast the actual results in a segment margin income format.

C. Compute variances between the budgeted segment margin income state¬ ment and the actual segment income statement. Identify and discuss the factors that are primarily responsible for the difference between the bud¬ geted and actual profit on the tax seminar. LO.1

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn