Question:

Silicon Valley Computer (SVC), the producer of keyboards for personal computers, which is discussed in the chapter, is a subsidiary of El Camino Corporation. Each year, headquarters of El Camino provides a capital budget to each of their subsidiaries, the amount of which is determined by the size of the subsidiary’s balance sheet. The senior management of SVC is considering to simplify their accounting and to move to one of the backflush costing systems in Exhibits 21-7, 21-8, or 21-9. Refer to exhibits 21-7, 21-8, and 21-9. Which of the backflush costing systems should the senior management of SVC choose if they want to maximize the capital budget that they receive from headquarters? Show your calculations.

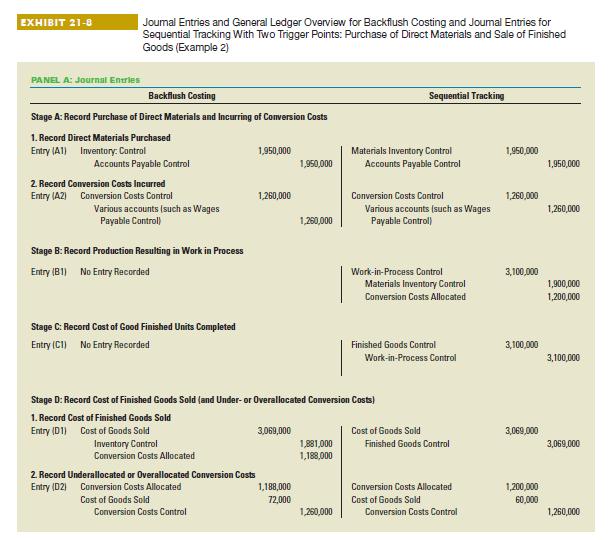

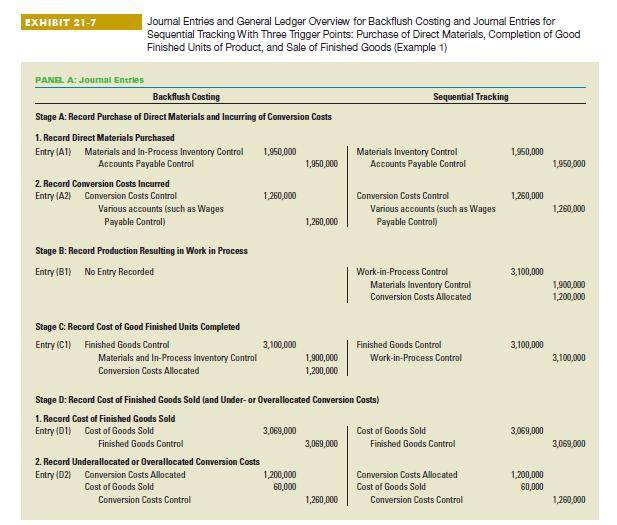

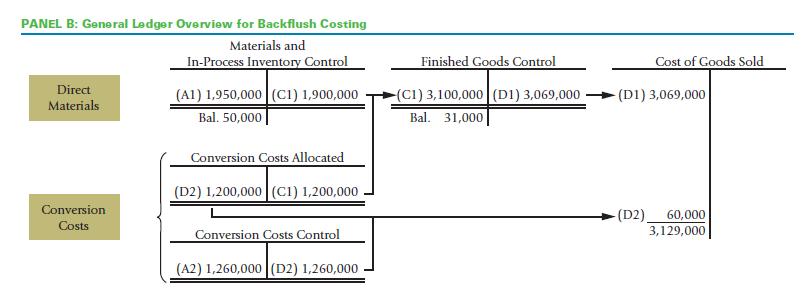

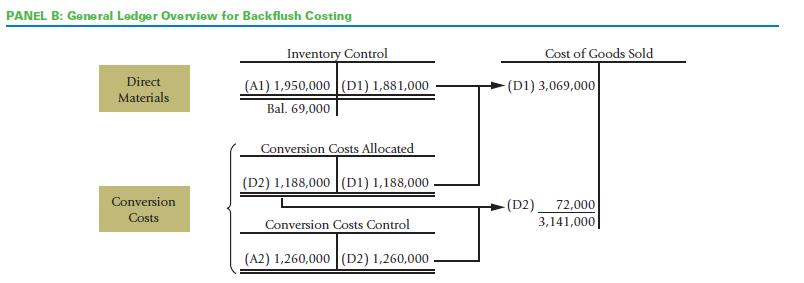

Data from Exhibit 21-7:

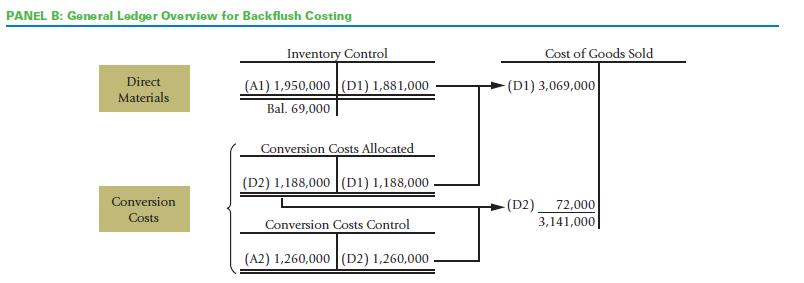

Data from Exhibit 21-8:

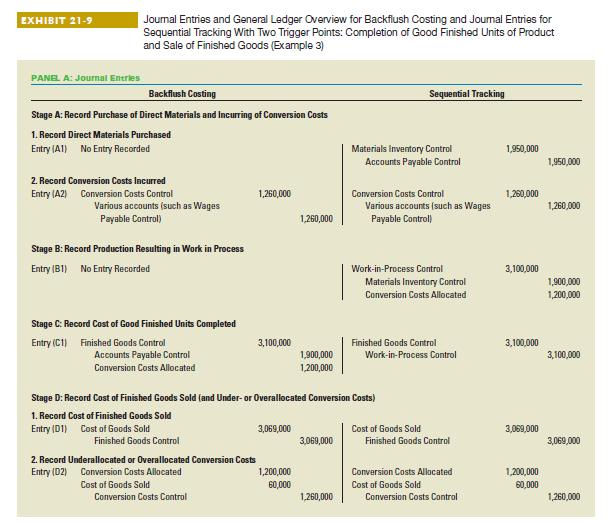

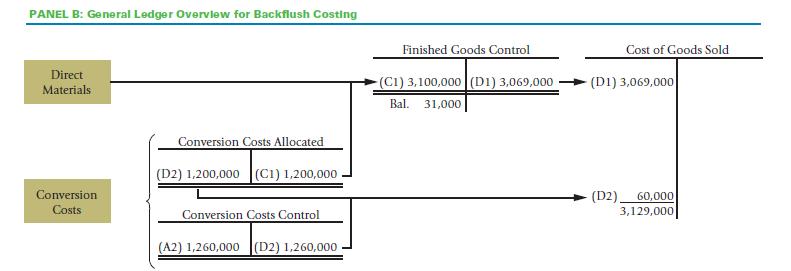

Data from Exhibit 21-9:

Transcribed Image Text:

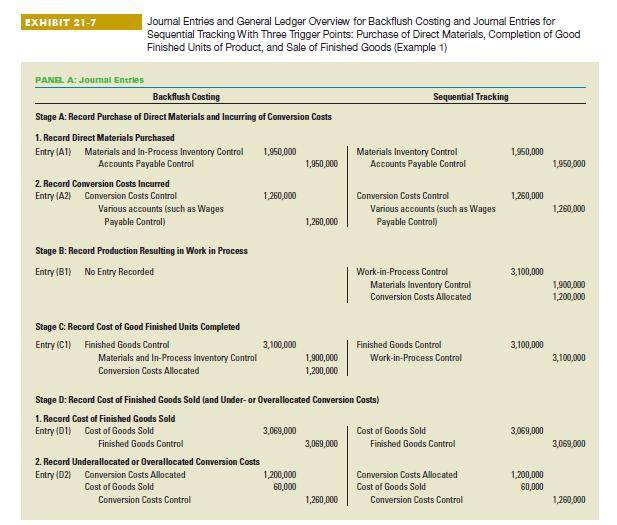

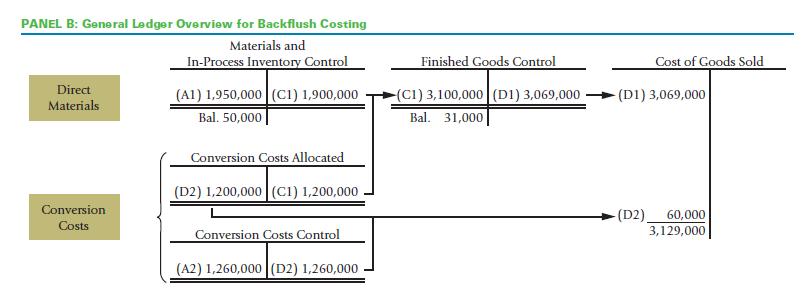

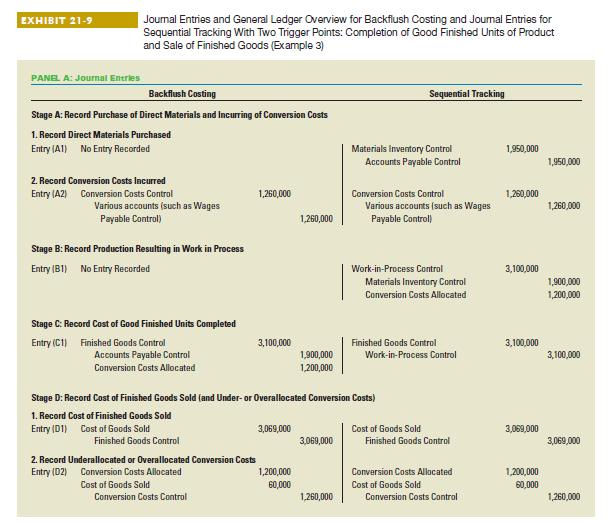

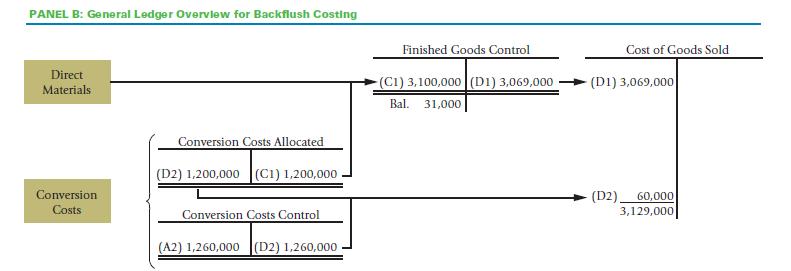

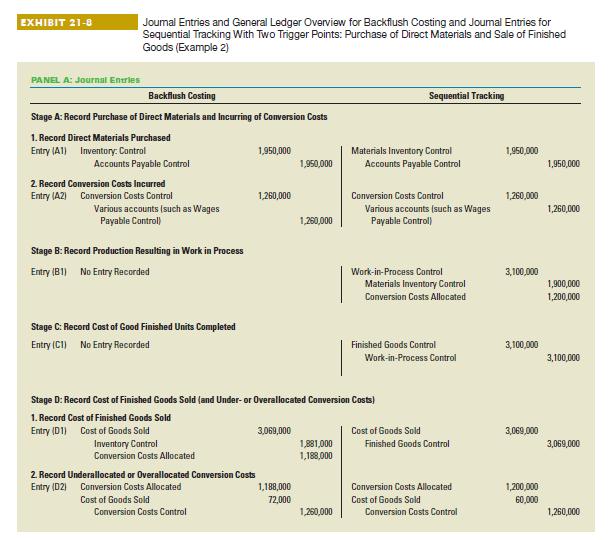

EXHIBIT 21-7

PANEL A: Journal Entries

Journal Entries and General Ledger Overview for Backflush Costing and Journal Entries for

Sequential Tracking With Three Trigger Points: Purchase of Direct Materials, Completion of Good

Finished Units of Product, and Sale of Finished Goods (Example 1)

Backflush Costing

Stage A: Record Purchase of Direct Materials and Incurring of Conversion Costs

1. Record Direct Materials Purchased

Entry (A1) Materials and in-Process Inventory Control

Accounts Payable Control

2. Record Conversion Costs incurred

Entry (A2) Conversion Costs Control

Various accounts (such as Wages

Payable Control)

Stage B: Record Production Resulting in Work in Process

Entry (B1) No Entry Recorded

Stage C: Record Cost of Good Finished Units Completed

Entry (C1) Finished Goods Control

Materials and In-Process Inventory Control

Conversion Costs Allocated

Finished Goods Control

2. Record Underallocated or Overallocated Conversion Costs

Entry (D2) Conversion Costs Allocated

Cost of Goods Sold

1,950,000

Conversion Costs Control

1,260,000

3,100,000

3,069,000

1,950,000

1,200,000

60,000

1,260,000

1,900,000

1,200,000

Stage D: Record Cost of Finished Goods Sold (and Under-or Overallocated Conversion Costs)

1. Record Cost of Finished Goods Sold

Entry (D1) Cost of Goods Sold

3,069,000

1,260,000

Materials Inventory Control

Accounts Payable Control

Sequential Tracking

Conversion Costs Control

Various accounts (such as Wages

Payable Control)

Work-in-Process Control

Materials Inventory Control

Conversion Costs Allocated

Finished Goods Control

Work-in-Process Control

Cost of Goods Sold

Finished Goods Control

Conversion Costs Allocated

Cost of Goods Sold

Conversion Costs Control

1,950,000

1,260,000

3,100,000

3,100,000

3,069,000

1,200,000

60,000

1,950,000

1,260,000

1,900,000

1,200,000

3,100,000

3,069,000

1,260,000