Sinclair Oil & Gas, a large energy conglomerate, jointly processes purchased hydrocarbons to generate three nonsalable intermediate

Question:

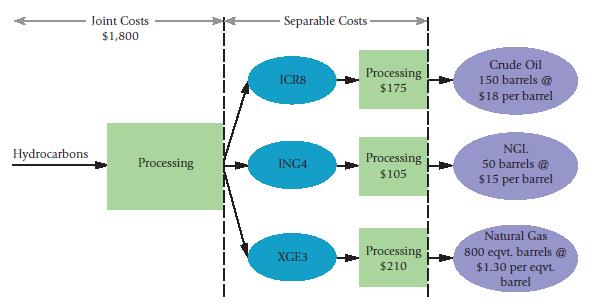

Sinclair Oil & Gas, a large energy conglomerate, jointly processes purchased hydrocarbons to generate three nonsalable intermediate products: ICR8, ING4, and XGE3. These intermediate products are further processed separately to produce crude oil, natural gas liquids (NGL), and natural gas (measured in liquid equivalents). An overview of the process and results for August 2014 are shown here.

A new federal law has recently been passed that taxes crude oil at 30% of operating income. No new tax is to be paid on natural gas liquid or natural gas. Starting August 2014, Sinclair Oil & Gas must report a separate product-line income statement for crude oil. One challenge facing Sinclair Oil & Gas is how to allocate the joint cost of producing the three separate salable outputs. Assume no beginning or ending inventory.

Required:

1. Allocate the August 2014 joint cost among the three products using the following:

a. Physical-measure method

b. NRV method

2. Show the operating income for each product using the methods in requirement 1.

3. Discuss the pros and cons of the two methods to Sinclair Oil & Gas for making decisions about product emphasis (pricing, sell-or-process-further decisions, and so on).

4. Draft a letter to the taxation authorities on behalf of Sinclair Oil & Gas that justifies the joint-cost-allocation method you recommend Sinclair use.

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0133428704

15th edition

Authors: Charles T. Horngren, Srikant M. Datar, Madhav V. Rajan