The owner of Ruggles Company, a sole proprietorship, decided she should acquire some new labor-saving equipment. If

Question:

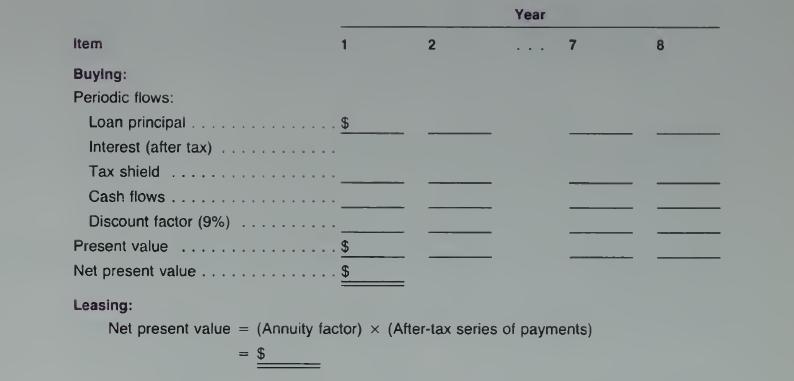

The owner of Ruggles Company, a sole proprietorship, decided she should acquire some new labor-saving equipment. If the equipment is acquired, it may either be leased or a special nonrecourse loan obtained for the total amount of the equipment purchase.

The lease calls for payments of $12,500 per year for eight years, whereas the loan calls for eight annual principal payments of $10,000 each plus 15 percent interest on the balance outstanding at the start of each year. Under the lease, the lessor obtains all tax benefits from equipment ownership.

The equipment, which cost $80,000, is depreciable for tax purposes as follows:

Year 1, $16,000; Year 2, $28,000; Years 3-5, $12,000 per year. The equipment will have no value at the end of the project life (eight years).

Ruggles has a tax rate of 40 percent and uses an after-tax borrowing rate of 9 percent to discount all cash flows.

Complete the schedule to determine whether Ruggles should lease or borrow and buy the asset. (Assume Ruggles has already decided to make the investment, but has not yet decided whether to lease or borrow.)

Step by Step Answer: