Time line; payback; NP) Raleigh Retail is considering expanding its build ing so it can stock additional

Question:

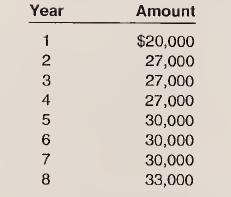

Time line; payback; NP\) Raleigh Retail is considering expanding its build¬ ing so it can stock additional merchandise for travelers and tourists. Store manager Ralph Lauren anticipates that building expansion costs would be $190,000. Lauren’s suppliers are willing to provide inventory on a consign¬ ment basis so he would have no additional working capital needs upon ex¬ pansion. Annual incremental fixed cash costs for the store expansion are expected to be as follows:

Lauren estimates that annual cash inflows could be increased by $240,000 from the additional merchandise sales. The firm’s contribution margin is typi¬ cally 25 percent of sales. Because of uncertainty about the future, Lauren does not want to consider any cash flows after eight years. The firm uses an 8 percent discount rate.

a. Construct a time line for the investment.

b. Determine the payback period. (Ignore taxes.)

c. Calculate the net present value of the project. (Ignore taxes.) LO.1

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn