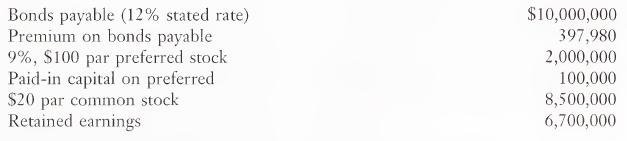

(Weighted average cost of capital) Cleveland Distillery has the following compo nents in its corporate structure: The...

Question:

(Weighted average cost of capital) Cleveland Distillery has the following compo¬ nents in its corporate structure:

The bonds were originally issued 10 years ago at $10,795,960 with a 20-year life. Interest on the bonds is paid and amortized on an annual basis. The com¬ pany uses straight-line amortization of bond discounts or premiums. The market yield of the bonds has not changed since the date of issue. The preferred stock was issued at $105 per share, and it is currently selling for $120. Common stockholders will receive a dividend of $3 next period. The most recent trading price of a common share is $45. Cleveland Distillery’s management has promised a dividend growth rate of 5 percent per year, and the tax rate for the company is 40 percent.

a. Determine the cost of capital for the bonds.

b. Determine the cost of capital for the preferred stock.

c. Determine the cost of capital for the common stock.

d. Determine the weighted average cost of capital using the following capital mix: bonds, 40 percent; preferred stock, 15 percent; and common stock, 45 percent.LO2

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney