Wyle and Partners, a regional accounting firm, performs yearly audits on a number of different for-profit and

Question:

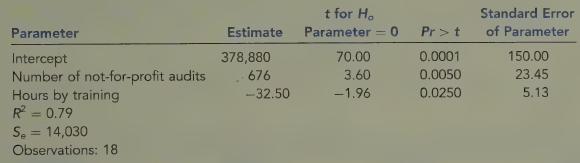

Wyle and Partners, a regional accounting firm, performs yearly audits on a number of different for-profit and not-for-profit entities. Two years ago, Callie Egbert, Wyle’s partner in charge of operations, became concerned about the amount of audit time required by not-for-profit entities. As a result, she instituted a series of training programs focusing on the auditing of not-for-profit entities. Now, she would like to see if the training seemed to work. So, she ran a multiple regression on 18 months of data for Wyle for three variables: the total monthly cost of audit professional time, the number of not-forprofit audits, and the hours of training in the audit of not-for-profit entities. The following printout was obtained:

Required:

1. Write out the cost equation for Wyle’s audit professional time.

2. If Wyle expects to have 12 audits of not-for-profits next month and expects that audit professionals will have a total of 220 hours of not-for-profit training, what is the anticipated cost of professional time?

3. Calculate a 99 percent confidence interval for the prediction made in Requirement 2.

4. Are the hours spent auditing not-for-profit entities positively or negatively correlated with audit professional costs? Is percentage of experienced team members positively or negatively correlated with audit professional cost?

5. What does R? mean in this equation? Overall, what is your evaluation of the cost equation that was developed for the cost of audit professionals?LO1

Step by Step Answer:

Introduction To Cost Accounting

ISBN: 9780538749633

1st International Edition

Authors: Don R. Hansen, Maryanne Mowen, Liming Guan, Mowen/Hansen