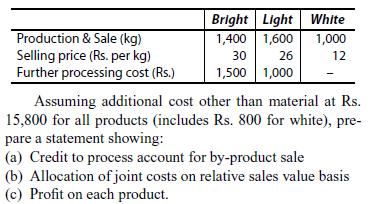

A manufacturing unit imports raw material and the process is to produce three different products, namely, bright,

Question:

A manufacturing unit imports raw material and the process is to produce three different products, namely, bright, light and white. The raw material has an FOB value of Rs. 5 per kg and freight and insurance are charged at 10% of FOB price. Customs duty as 120% of CIF is levied at the time of import. Auxiliary duty at 20% is also charged on CIF price. Countervailing duty is charged on CIF plus duty at 10%.

The landed cost includes 5% for clearing charges.

Bright and light are joint products while white emerges as a by-product. The value of by-product after deducting 30% (10% being notional profi t and 20% for selling expenses) from sales value is credited to process account. The unit consumed 4,000 kg of raw materials during a year. The relevant data are as follows:

Step by Step Answer: