Accounting for payroll The Bean Blossom String Factory manufactures musical instru- ments, and uses a job order

Question:

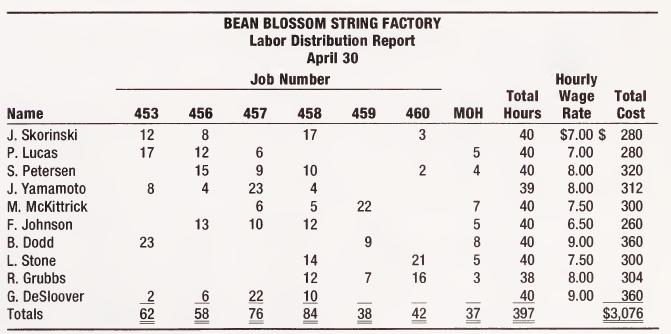

Accounting for payroll The Bean Blossom String Factory manufactures musical instru- ments, and uses a job order costing system to measure product costs. Employees prepare time tickets identifying the jobs they worked on during the day. Any time not identified with a specific job is classified as indirect labor and charged to manufacturing overhead. A payroll distribution report is prepared weekly and is the basis for making the payroll journal entries and assigning payroll costs to production. Below is the labor distribution report for the last week in April.

In addition to gross wages the company must pay FICA taxes of 7 percent, state unemploy- ment taxes of 2 percent, and federal unemployment taxes of .7 percent. Assume that 15 percent of gross wages are withheld from employees checks for federal income taxes, 7 percent for FICA taxes, 5 percent is withheld for state income taxes, and 3 percent is withheld for union dues.

Step by Step Answer: