(AlCPA adapted) Cash requirements budget The Loading Company is planning to con- struct a two-unit facility for...

Question:

(AlCPA adapted) Cash requirements budget The Loading Company is planning to con- struct a two-unit facility for the loading of iron ore into ships. On or before January 1,1993, the stockholders will invest $100,000 in the company's capital stock to provide its initial working capital. To finance the construction program (the total planned cost of which is $1,800,000), the company will obtain a commitment from a lending organization for a loan of $1,800,000. This loan is to be secured by a 10-year mortgage note bearing interest at 5 percent per year on the unpaid balance. The principal amount of the loan is to be repaid in equal semiannual installments of $100,000 beginning June 30,1994.

Inasmuch as the proceeds of the loan will only be required as construction work progresses, the company has agreed to pay a commitment fee beginning January 1, 1993 equal to 1 percent per year on the unused portion of the loan commitment. This fee is payable at the time amounts are "drawn-down," except at the time of the first "draw-down."

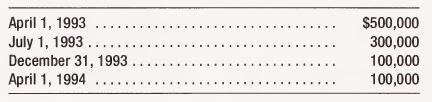

Work on the construction of the facility will commence in the fall of 1992. The first payment to the contractor will be due on January 1, 1993, at which time the commitment and loan agreement will become effective and the company will make its first "draw-down," for payment to the contractor, in the amount of $800,000. As construction progresses, additional payments will be made to the contractors by "drawing-down" the remaining loan proceeds as follows (it is assumed that payment to the contractors will be made on the same dates as the loan proceeds are "drawn-down"):

Because of weather conditions, the facility can operate only from April 1 through November 30 of each year. The construction program will permit the completion of the first of the two plant units (capable of handling 5,000,000 tons) in time for its use during the 1993 shipping season. The second unit (capable of handling an additional 3,000,000 tons) will be completed in time for the 1994 season. It is expected that 5,000,000 tons will be handled by the facility during the 1993 season; thereafter, the tonnage handled is expected to increase in each subsequent year by 300,000 tons until a level of 6,500,000 tons is reached.

The company'S’revenues will be derived by charging the consignees of the ore for its services at a fixed rate per ton loaded. Billing terms will be net, ten days. Based upon past experience with similar facilities elsewhere, it is expected that the Loading Company's operating profit should average $.04 per ton before charges for interest, finance charges, and depreciation of $.03 per ton.

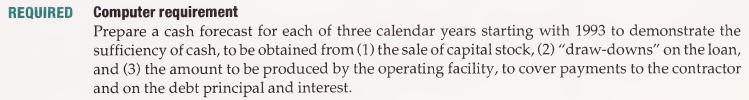

Step by Step Answer: