Allocated Costs and Incentive Contracts: Volume Sales Company has a highly competitive organization. Division managers (and division

Question:

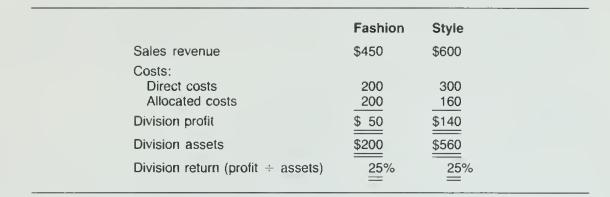

Allocated Costs and Incentive Contracts: Volume Sales Company has a highly competitive organization. Division managers (and division employees) receive a bonus if the division reports "above-average" returns for a year. Profits are determined using allocated common costs. Returns are measured by dividing profits by the book value of assets in each division. The following profit and performance reports were prepared for the managers of the Fashion and Style divisions, two of many divisions in the company (dollar figures are in thousands):

The average return for the company was also 25 percent. The manager of the Fashion Division notes that allocated costs were distributed to each division on the basis of number of employees. She suggests that costs should be allocated on the basis of assets because the allocated costs are headquarters' costs. In her view, the primary role of headquarters is to provide assets for the use of operating divisions. Had the costs been allocated on the basis of division assets, she calculated that the Fashion Division would have been allocated with costs of $140 and the Style Division with costs of $390.

The manager of the Style Division argues that central management is really concerned with maintaining employee relations. The advantage to a large organiza- tion such as this one is that employees identify with the company, not just with a division. He further asserts that the greater an employee's pay, the more the em- ployee requires services of corporate headquarters. He therefore suggests that payroll costs be used as the basis for allocation of the common costs. If payroll costs were used, he calculated that the Fashion Division would be allocated with $220 of allocated costs and the Style Division with $135.

Required: What would be each division's return using each manager's proposal? What sug- gestions do you have for the solution to the incentive compensation problem for Volume Sales Company?

Step by Step Answer: