Allocating common costs to joint products by three methodsphysical units, relative sales value, and net realizable sales

Question:

Allocating common costs to joint products by three methods—physical units, relative sales value, and net realizable sales value.

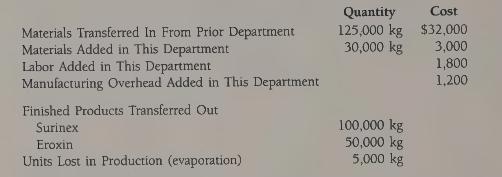

The Shreveport Chemical Company uses a manufacturing process that produces two major products, Eroxin and Surinex. In the first department, the raw materials are mixed and treated. In the second department, some additional raw materials are added, the mix is further processed, and the two products are then separated. Cost and production data for the second department for the month of June 19X2 are as follows:

There was no beginning or ending work in process inventory. Surinex has a sales price of $.36 per kilogram, and Eroxin has a sales price of $.32 per kilogram.

Estimated selling and administrative expenses: Surinex, $.09 per kilogram, and Eroxin, $.02 per kilogram.

Instructions 1. Prepare schedules showing the allocation of each element of manufacturing cost to each kilogram of Surinex and each kilogram of Eroxin, using the following assumptions. (Round off the unit costs to four decimal places.)

a. Costs are allocated on a per-kilogram basis to the joint products.

b. Costs are allocated to the two products on the basis of relative sales value.

c. Costs are allocated to each product on the basis of net realizable sales value (the sales price less applicable selling and administrative expenses).

2. Prepare condensed income statements showing the profit that would be reported on each product under each of the three allocation methods.

Step by Step Answer:

Cost Accounting Principles And Applications

ISBN: 9780070081529

5th Edition

Authors: Horace R. Brock