Allocation of joint costs LO 5 Robin Manufacturing Company buys crypton for $0.80 a gallon. At the

Question:

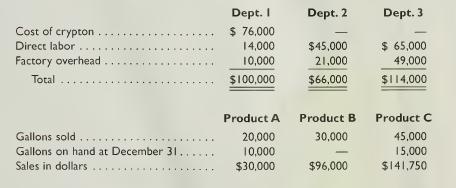

Allocation of joint costs LO5 Robin Manufacturing Company buys crypton for $0.80 a gallon. At the end of processing in Dept. I, crypton splits off into products A, B, and C. Product A is sold at the split-off point with no further processing. Products B and C require further processing before they can be sold. Product B is processed in Dept. 2, and Product C is processed in Dept. 3. Following is a summary of costs and other related data for the year ended December 3 1

No inventories were on hand at the beginning of the year, and no crypton was on hand at the end of the year. All gallons on hand at the end of the year were complete as to processing. Robin uses the relative sales value method of allocating joint costs.

No inventories were on hand at the beginning of the year, and no crypton was on hand at the end of the year. All gallons on hand at the end of the year were complete as to processing. Robin uses the relative sales value method of allocating joint costs.

REQUIRED:

1. Calculate the allocation of joint costs.

2. Calculate the cost of Product B sold.

Step by Step Answer: