Apply Overhead Using a Predetermined Rate (Multiple Choice): Bowen Company uses a job order accounting system for

Question:

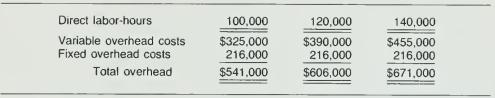

Apply Overhead Using a Predetermined Rate (Multiple Choice): Bowen Company uses a job order accounting system for its production costs. A predetermined overhead rate based on direct-labor hours is used to apply overhead to individual jobs. An estimate of overhead costs at different volumes was prepared for the current year as follows:

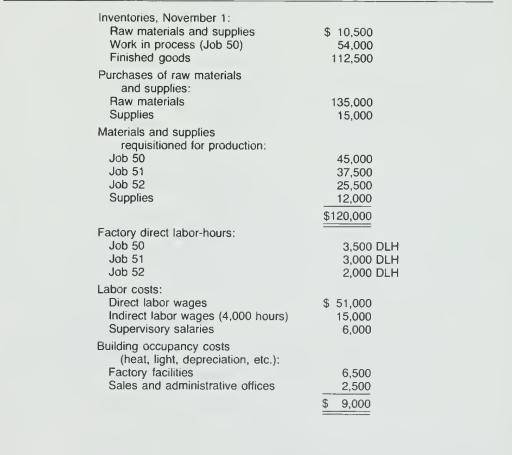

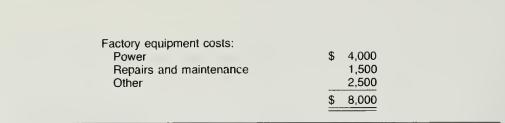

The expected volume is 120.000 direct labor-hours for the entire year. The following information is for November. Jobs 50 and 51 were completed during November.

Required: Answer the following multiple-choice questions.

Answer the following multiple-choice questions.

1. The predetermined overhead rate (combined fixed and variable) to be used to apply overhead to individual jobs during the year is:

a. $3.25 per DLH.

b. $4.69 per DLH.

c. $5.05 per DLH.

d. $5.41 per DLH.

e. None of these. Note: Without prejudice to your answer to requirement I, assume that the predetermined overhead rate is $4.50 per direct labor-hour. Use this amount in answering requirements 2 through 5.

2. The total cost of job 50 when it is finished is:

a. $81,750.

b. $135,750.

c. $142,750.

d. $146,750.

e. None of these.

3. The factory overhead costs applied to job 52 during November were:

a. $9,000.

b. $47,500.

c. $46,500.

d. $8,000.

e. None of these.

4. The total amount of overhead applied to jobs during November was:

a. $29,250.

b. $38,250.

c. $47,250.

d. $56,250.

e. None of these.

5. Actual factory overhead incurred during November was:

a. $38,000.

b. $41,500.

c. $47,500.

d. $50,500. e . None of these.

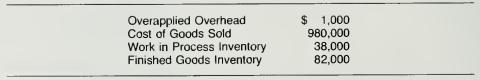

6. At the end of the year, Bowen Company had the following account balances:

What would be the most common treatment of the overapplied overhead?

a. Prorate it between work in process inventory and finished goods inventory.

b. Prorate it between work in process inventory, finished goods inventory, and cost of goods sold.

c. Carry it as a credit on the balance sheet.

d. Carry it as miscellaneous operating revenue on the income statement.

e. Credit it to cost of goods sold.

Step by Step Answer: