Assess Net Present Value of Training Costs: MacDonald & Company operates a diversified company with several operating

Question:

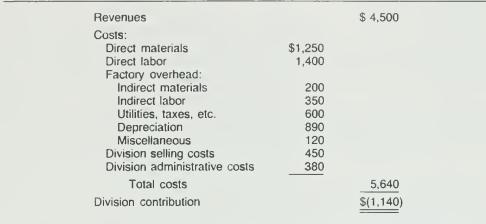

Assess Net Present Value of Training Costs: MacDonald & Company operates a diversified company with several operating divisions. Division M has consistently shown losses. Management is considering a proposal to obtain training for division M employees that is designed to reduce labor and other operating costs. The latest division income statement appears as follows (all dollar amounts in this problem have 000 omitted):

The costs are expected to continue in the future unless the training is obtained. With the training, direct labor is expected to be reduced by 55 percent, and other costs are expected to be reduced by $275 per year. These cost savings will continue for 10 years. The training will cost $5,000 and can be deducted for tax purposes in the year it is obtained. Working capital can be reduced by $110 if the new training is purchased.

Required: If the company's cost of capital is 12 percent and its marginal tax rate is 40 percent. determine whether the new training should be purchased. Show supporting computations.

Step by Step Answer: