Based on an optimistic sales forecast, the management of the Usell Corporation has estimated production of 6,000

Question:

Based on an optimistic sales forecast, the management of the Usell Corporation has estimated production of 6,000 units of its product in 19X2. Man- agement now wants to develop a budget for production costs based on the assump- tion that 6,000 units will be produced. However, certain members of management are less optimistic and believe that only 5,600 units can be sold. You have been asked to prepare a budget for production costs based on 6,000 units and one based on 5,600 units. The company has not previously had a budget. You analyze last year's production costs, when 5,000 units were produced, and learn the following facts:

1. To produce 5,000 units, 20,000 pounds of raw materials were required at an average cost of $8 per pound. However, at the end of 19X1, materials cost $8.20 per pound, and it is anticipated that materials will increase by an average of an additional 10 percent during 19X2. The beginning and ending inventories of materials on hand in 19X1 were so small that they were insignificant.

2. Each unit of product required 6.5 hours of direct labor. During 19X1, labor costs were $9 per hour. During the first half of 19X2, labor costs should remain at $9 per hour, but the firm’s contract with its union calls for an increase to $9.75 per hour at the midpoint of 19X2. Production is spread evenly throughout the year. The installation of new equipment at the beginning of 19X2 is expected to reduce the average labor time to 5.9 hours per unit.

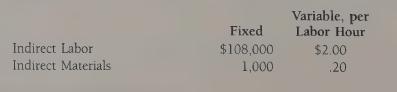

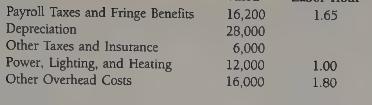

3. Overhead costs in 19X1 have been analyzed into fixed and variable parts, as follows:

It is anticipated that all indirect labor cost rates will increase by 12 percent and that payroll taxes and fringe benefits will be 16 percent of labor costs. The costs for indirect materials; for heating, lighting, and power; and for other overhead are expected to increase by 5 percent. Because of the new labor-saving equipment, depreciation will increase by $14,000 per year. Other taxes and insurance will increase by $4,000 per year.

Prepare the budget requested at production levels of 5,600 units and 6,000 units.

Carry all unit costs to four decimal places. Round all budgeted costs to the nearest dollar.

Step by Step Answer:

Cost Accounting Principles And Applications

ISBN: 9780070081529

5th Edition

Authors: Horace R. Brock