Bayview Manufacturing Company (Linear Programming and Cost Estimation) 5 : (Computer required.) In November 1984, the Bayview

Question:

Bayview Manufacturing Company (Linear Programming and Cost Estimation)5 : (Computer required.) In November 1984, the Bayview Manufacturing Company was in the process of preparing its budget for 1985. As the first step. it prepared a pro forma income statement for 1984 based on the first 10 months' operations and revised plans for the last two months. This income statement. in condensed form. was as follows:

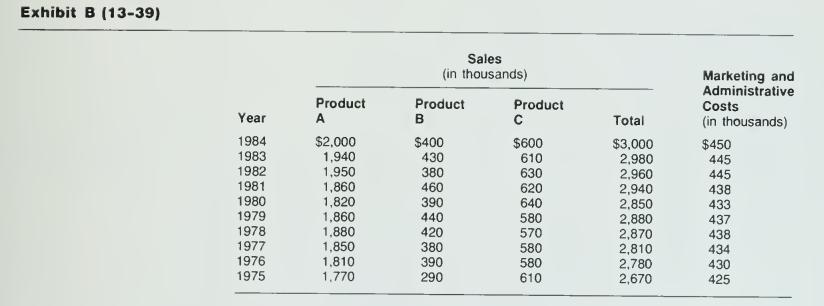

These results were better than expected and operations were close to capacity, but Bayview's management was not convinced that demand would remain at present levels and hence had not planned any increase in plant capacity. Its equipment was specialized and made to its order; over a year's lead time was necessary on all plant additions. Bayview produces three products; sales have been broken down by product, as follows:

Management has ordered a profit analysis for each product and has available the following information:

Factory overhead has been applied on the basis of direct labor costs at a rate of 250 percent, and management asserts that approximately 20 percent of the overhead is variable and does vary with labor costs. Selling and administrative costs have been allocated on the basis of sales at the rate of 15 percent; approximately one half of this is variable and does vary with sales in dollars. All of the labor expense is considered to be variable. As the first step in the planning process, the sales department has been asked to make estimates of what it could sell; these estimates have been reviewed by the firm's consulting economist and by top management. They are as follows:

Production of these quantities was immediately recognized as being impossible. Estimated cost data for the three products, each of which requires activity of both departments, were based on the following production rates:

Practical capacity in department 1 is 67,000 hours and in department 2, 63,000 hours; and the industrial engineering department has concluded that this cannot be in- creased without the purchase of additional equipment. Thus, while last year depart- ment operated at 99 percent of its capacity and department 2 at 71 percent of capacity, anticipated sales would require operating both departments 1 and 2 at more than 100 percent capacity. These solutions to the limited production problem have been rejected: (1) sub- contracting the production out to other firms is considered to be unprofitable because of problems of maintaining quality. (2) operating a second shift is impossible because of a shortage of labor, and (3) operating overtime would create problems because a large number of employees are "moonlighting" and would therefore refuse to work more than the normal 40-hour week. Price increases have been rejected; although they would result in higher profits this year, the long-run competitive position of the firm would be weakened, resulting in lower profits in the future.

The treasurer then suggested that product C has been carried at a loss too long and that now was the time to eliminate it from the product line. If all facilities are used to produce A and B, profits would increase.

The sales manager objected to this solution because of the need to carry a full line. In addition, he maintains that there is a group of loyal customers whose needs must be met. He provided a list of these customers and their estimated purchases (in units), which total as follows:

These contentions appeared to be reasonable and served to narrow the bounds of the problem, so the president concurred. The treasurer reluctantly acquiesced but maintained that the remaining capacity should be used to produce A and B. Because A produced 2.4 times as much profit as B, he suggested that the production of A (in excess of the 80,000 minimum set by the sales manager) be 2.4 times that of B (in excess of the 32,000 minimum set by the sales manager). The production manager made some quick calculations and said the budgeted production and sales would be about:

The treasurer then made a calculation of profits as follows:

As this would represent an increase of almost 15 percent over the current year, there was a general feeling of self-satisfaction. Before final approval was given, however, the president said that he would like to have his new assistant check over the figures. Somewhat piqued, the treasurer agreed, and at that point the group adjourned.

The next day the above information was submitted to you as your first assignment in your new job as the president's assistant.

Required: Prepare an analysis showing the president what he should do.

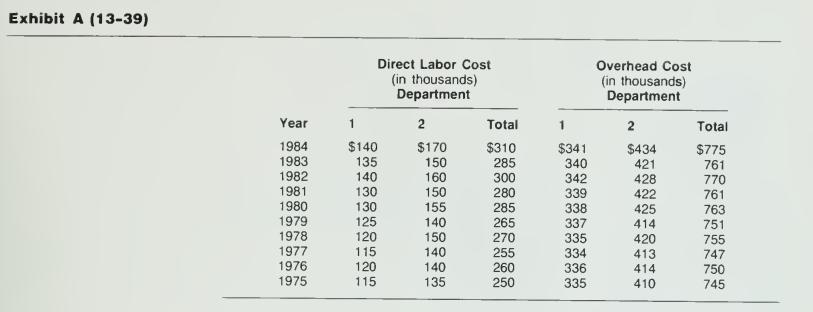

Exhibits A and B contain information that you are able to obtain from the accounting system, which may help you to estimate an overhead cost breakdown into fixed and variable components different from that given in the case. (This breakdown was required for case 10-38 in Chapter 10.)

Step by Step Answer: