Capital Investment Analysis under Inflation with Investment Tax Credit: Each division of Catix Company has the authority

Question:

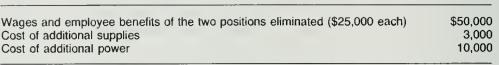

Capital Investment Analysis under Inflation with Investment Tax Credit: Each division of Catix Company has the authority to make capital expenditures up to $200,000 without approval of the corporate headquarters. The corporate controller has determined that the cost of capital for Catix Corporation is 12 percent. This rate does not include an allowance for inflation, which is expected to occur at an average rate of 8 percent each year. Catix pays income taxes at the rate of 40 percent. The Electronic Division of Catix is considering the purchase of automated machinery for manufacture of its printed circuit boards. The divisional controller estimates that if the machine is purchased, two positions will be eliminated, yielding a cost savings for wages and employee benefits. However, the machine would require additional supplies and more power. The cost savings and additional costs in beginning of Year 1 prices are as follows:

The new machine would be purchased and installed at the beginning of Year 1 at a net cost of $80,000. If purchased, the machine would be depreciated for tax purposes as follows: Year 1, $16,000; Year 2, $28,000; Years 3-5, $12,000 each year. It would qualify for an investment tax credit of $8,000 in Year 1. The machine will become technologically obsolete in eight years and will have no salvage value at that time. The Electronics Division compensates for inflation in capital expenditure analyses by adjusting the above cash flows for inflation, starting with end of Year 1 cash flows. The adjusted after-tax cash flows are then discounted using the appropriate discount rate. No changes are expected in working capital.

Required: Prepare a schedule showing the expected future cash flows in nominal dollars. Also show the net present value of the project. (See Illustration 15-11 for present value factors under inflation.)

Step by Step Answer: