(CMA) Understanding process costing data with spoiied units JC Company employs a pro- cess cost system. A...

Question:

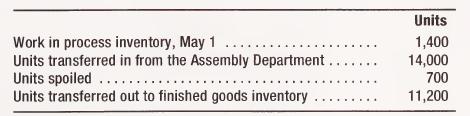

(CMA) Understanding process costing data with spoiied units JC Company employs a pro- cess cost system. A unit of product passes through three departments—Molding, Assembly, and Finishing. The following activity took place in the Finishing Department during May:

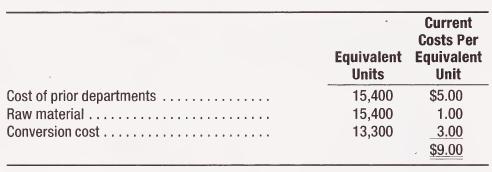

Raw material is added at the beginning of the processing in the Finishing Department without changing the number of units being processed. The work in process inventory was 70 percent complete as to conversion on May 1 and 40 percent complete as to conversion on May 31. All spoilage was discovered at final inspection before the units were transferred to finished goods; 560 of the units spoiled were within the limit considered normal. JC Company employs the weighted average costing method. The equivalent units and the current costs per equivalent unit of production for each cost factor are as follow:

1. The cost of production transferred to the finished goods inventory is

a. $100,800.

b. $105,840

c. $107,100.

d. $102,060.

e. none of the above.

2. The cost assigned to work-in-process inventory on May 31 is

a. $28,000.

b. $31,000.

c. $25,200.

d. $30,240.

3. If the total costs of prior departments included in the work in process inventory of the Finishing Department on M^y 1 amounted to $6,300, the total cost transferred in from the Assembly Department to the Finishing Department during May is

a. $70,000.

b. $62,300.

c. $70,700.

d. $63,700.

e. none of the above.

4. The cost associated with the abnormal spoilage is

a. $6,300.

b. $1,260.

c. $560.

d. $840.

e. none of the above.

5. The cost associated with abnormal spoilage ordinarily would be

a. charged to inventory.

b. charged to a material variance account,

c. charged to retained earnings.

d. charged to manufacturing overhead.

e. charged to a special loss account.

Step by Step Answer: