Comparative Income Statements, with Variances: A client requested your help to analyze the operations of one of

Question:

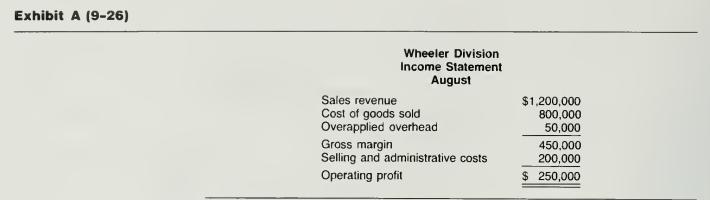

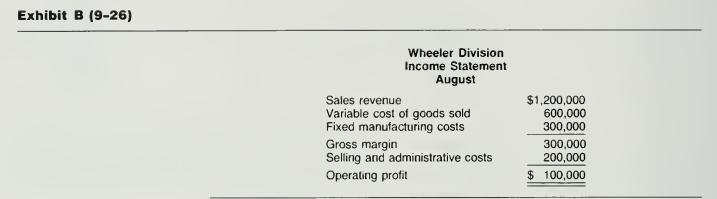

Comparative Income Statements, with Variances: A client requested your help to analyze the operations of one of her divisions, the Wheeler Division. "I don't understand this! I received this income statement yester- day from the Wheeler Division managers (see Exhibit A). but one of our internal auditors came across this other one (see Exhibit B). The second statement shows a lower net income! I think something strange is going on here. It looks like the division managers are sending me this first statement (in Exhibit A), which makes them look good, while they're hiding the second statement (in Exhibit B), which shows what's really going on. I want you to look into this for me."

Required:

a. How many units were sold in August?

b. What was the expected and actual production (units) in August?

Notes:

(1) Fixed manufacturing costs applied at predetermined rate of $2 per unit.

(2) No under- or overapplied overhead is prorated to inventories.

(3) Ending inventory is $640,000.

c. What was the beginning and ending inventory (units) in August?

d.(1) What were the actual fixed costs incurred in August?

(2) What were the total amount of fixed costs expensed on the income statement under full-absorption costing?

Step by Step Answer: