Comparison of Full- Absorption to Variable Costing with Product Mix: Classic Brew Corporation operates a processing plant

Question:

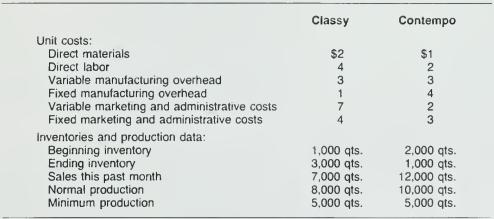

Comparison of Full- Absorption to Variable Costing with Product Mix: Classic Brew Corporation operates a processing plant in West Covina, California, that manufacturers two types of a popular soft drink: Classy and Contempo. Classy sells for $26 per quart, while Contempo sells for $14 per quart. A dispute broke out among management concerning the sales effort that should be devoted to each product. Some managers felt that greater emphasis should be placed on Classy because it offers a greater profit per quart. Other managers voted to increase sales of Contempo because it required less labor to manufacture, and labor was in short supply. You have been hired to advise on the appropriate selling emphasis. The following information is extracted from the accounting records:

Minimum production requirements are established by equipment specifications and cannot be changed. There have been no cost changes in the past few years. FIFO inventory flows are assumed.

Required:

a. Prepare a variable costing income statement for last month.

b. Prepare a full-absorption costing income statement for last month.

c. For Contempo only, prepare a reconciliation between the operating profits in

(a) and (b).

Step by Step Answer: